PARKS COMMISSION

Please see the Parks tab on home page for more information

ASSESSOR’S OFFICE

Stephen Jones, Assessor

Phone: (810) 385-4489 x1101

Email: sjones@fortgratiot.us

Autumn Westbrook, Assessing Clerk

Phone: (810) 385-4489 x1106

Email: awestbrook@fortgratiot.us

Click here for Property Records, Tax Information & Cemetery Records

The Assessing Department is responsible for assessing all Real and Personal Property located within Fort Gratiot. The task of assessing requires the maintenance of records on each parcel of property. The department is computerizing the assessing records. In the future, the computerized records will include land sketches, building sketches and a picture of each property, along with the Equalizer Valuation information.

Assessments are reviewed each year. Assessment Change Notices are mailed at the end of February. Board of Review meets to hear aggrieved taxpayers the Monday following the first Tuesday in March. Time and dates of these meetings are written on the change notices. More forms are available by clicking the “Download” Tab.

- Property Transfer Affidavits: (Download the Application)Property Transfer Affidavits must to be received by this office within 45 days of property transfer.

- PRE-Principal Residence Exemption (Homestead) Affidavits: (Download the Affidavit) PRE Affidavits are required for Exemption of the 18 Mill School Tax that is part of the tax bill. Filing Deadline is May 1st of the calendar year. The property listed MUST BE THE PRIMARY RESIDENCE, OWNED and OCCUPIED by the individual(s) requesting the exemption.

Poverty Exemptions Applications: (Download the Application) General Property Tax Law 211.7u Poverty Exemption Application forms can be requested from and returned to this office.

- Click here for the 2023 Federal Poverty Guidelines and Board of Review Dates

- Click here for the 2023 Poverty Exemption Application Guidelines

- More Assessing Forms can be found by clicking here

PERSONAL PROPERTY TAXATION CHANGES EFFECTIVE DECEMBER 31, 2013. In December of 2012, Governor Snyder signed into law eleven bills affecting the taxation of personal property. The majority of these Acts do not take effect until December 31, 2015 for the 2016 Tax Year.

However, P.A. 402 of 2012 as amended by P.A. 153 of 2013, MCL 211.9o, is effective December 31, 2013 for the 2014 Tax Year. Click here to see the Michigan State Tax Commission Bulletin 11 of 2013 which provides guidance and explanation on the changes effective December 31, 2013

INFORMATION FOR DISABLED VETERANS EXEMPTIONS

Eligibility Requirements:

In order to be eligible for the exemption, the disabled veteran must have been honorably discharged from the armed forces of the United States. They must be a Michigan resident. Additionally, they must meet one of the following criteria:

(a) Has been determined by the United States department of veterans’ affairs to be permanently and totally disabled as a result of military service and entitled to veterans’ benefits at the 100% rate.

(b) Has a certificate from the United States veterans’ administration, or its successors, certifying that he or she is receiving or has received pecuniary assistance due to disability for specially adapted housing.

(c) Has been rated by the United States department of veterans’ affairs as indiidually unemployable.

The unremarried surviving spouse of the disable veteran is eligible for the exemption based upon the eligibility of their spouse; therefore the spouse must also be a Michigan resident. The exemption will continue only as long as the surviving spouse remains unremarried.

How is a determination made that the disabled veteran is permanently and totally disabled as a result of military service and entitled to veterans’ benefits at the 100% rate?

The Veterans’ Administration defines a service connected disability as a disability related to an injury or disease that developed during or was aggravated while on active duty or active duty for training.[1] The Veterans Administration Schedule for Rating Disabilities is used to assess the medical conditions and illnesses incurred or aggravated during the veteran’s military service and a percentage rating from 0% to 100% is assigned based on the severity of the disability.

Individuals filing the affidavit for the exemption under criteria a) must provide a copy of the letter from the Veterans’ Administration indicating they have a 100% service connected disability and are entitled to receive benefits.

Note: The Act does not require the disabled veteran to have already received the benefit, it only requires that they have been determined to be permanently and totally disabled as a result of military service and entitled to veterans’ benefits at the 100% rate.

What is assistance for specially adapted housing?

The Veterans’ Administration provides veterans with certain permanent and total service-connected disabilities financial assistance to purchase or construct an adapted home or modify an existing home to accommodate a disability. There are two grant programs: specially adapted housing grant (SAH) and the special housing adaptation grant (SHA).[2]

The State Tax Commission has determined that receipt of either grant would qualify an individual for the exemption under criteria b).

Individuals filing the affidavit for the exemption under criteria b) must provide a copy of the certificate from the Veterans’ Administration indicating they are receiving or have received pecuniary assistance due to disability for specially adapted housing.

What does individually unemployable mean?

Individual unemployability is part of the Veterans’ Administration disability compensation program. Under this program, veterans may receive compensation at the 100% rate even though their service connected disability is not rated at 100%.[3]

In order to be eligible a veteran must prove they are unable to maintain substantially gainful employment as a result of their service connected disability. In addition they must have one service connected disability rated at 60% or more or two or more service connected disabilities with at least one rated at 40% or more with a combined rating of 70% or more.[4]

Individuals filing the affidavit for the exemption under criteria c) must provide a copy of the letter from the Veterans’ Administration indicating they are individually unemployable.

Is there an asset test and/or means test to determine eligibility?

No, there is no asset test and/or means test to determine eligibility. In order to be eligible the disabled veteran must meet the requirements of Public Act 161 of 2013 regardless of their income or the value of their home.

[1] Summary of VA Benefits for Disabled Veterans

[2] U.S. Department of Veterans Affairs Housing Grants for Disabled Veterans

[3] Veteran’s Affairs Individual Unemployability Fact Sheet

[4] Veteran’s Affairs Individual Unemployability Fact Sheet

| State Tax Commission PO Box 30471 Lansing, Michigan 48909-7971 Phone: (517) 335-3429 Fax: (517) 241-1650 Email: State-Tax-Commission@michigan.gov |

Please complete the form, below and return to the Assessors Office no later than December 6, 2013 to be considered at the December Board of Review for the 2013 tax year.

1. This exemption is only available to disabled veterans or, if the veteran has died, to their un-remarried surviving spouse who own and use the home as their homestead.

2. The disabled veteran or their surviving spouse must be a resident of the State of Michigan.

3. Assessors are advised that eligible disabled veterans will be able to apply for a 2013 exemption at the December 2013 Board of Review. An exemption will cancel the July and December 2013 taxes, but will not cancel any taxes levied before 2013.

For the 2021 tax year, the form must be submitted no later than Friday, March 14, 2022.

Click here for the Claim for Disabled Veterans Exemption Fillable Form

Click here to be redirected to the Michigan Legislature Bill and Public Act Search

BOARD OF REVIEW

*SEEKING ONE OR TWO ALTERNATE BOARD OF REVIEW MEMBERS*

The Board of Review meets approximately seven (7) times per year. The dates for 2024 are below. All meetings are held at the Fort Gratiot Municipal Center beginning at 9:00 AM and may go as late at 5:00 PM. Training opportunities are available and attendance is strongly encouraged for members throughout the year. (Starting in 2021 some training will be mandatory, AT LEAST ONCE PER TERM.) Cost, meals, and mileage are paid in advance and/or reimbursed.

The term is January 1, 2024 through January 1, 2025. Members are compensated $500 for March, $50 for July and $50 for December.

Any person interested in being considered for an appointment to the Board of Review must submit a letter/email of interest to the Fort Gratiot Charter Township Board of Trustees. Emails may be sent to vostrander@fortgratiot.us or letters can be mailed or dropped off at the FGMC, 3720 Keewahdin Road, Fort Gratiot, Michigan 48059. Letters/emails of interest must be received no later than Friday, February 24, 2023 at 4:00 PM to be considered. The appointments will be made no later than the Wednesday March 1, 2024 Board of Trustees meeting.

The Fort Gratiot Township Board of Review is made up of four or five people: three members and one or two alternates. The members are Bonnie Barrett, Dean Marlar, Jodi Smith and Patti Bundy (alternate). Below are the dates the BOR will meet in 2024, the answers to some frequently asked questions and some forms that may be necessary to be filed or taken to the BOR’s.

2024 BOARD OF REVIEW MEETING DATES (click for more info)

Tuesday, March 5, 2024, 9:00 AM

Organizational – No appeals heard

Monday, March 11, 9:00 AM – 12 PM & 1 PM – 4 PM

BY APPOINTMENT Appeals Only – No Corrections

Thursday, March 14, 6 PM – 9 PM

BY APPOINTMENT Appeals Only – No Corrections

Friday, March 15, 9 AM – 12 PM

BY APPOINTMENT Appeals Only – No Corrections

Letter appeals are due by 12:00 PM on Thursday, March 14, to be considered

Decision and Corrections will be made the following week; week of March 18 to March 22, 2024. A special meeting notice will be posted at least 18 hours before said meetings.

Tuesday, July 16, 9:00 AM

Clerical errors and mutual mistakes of fact, PRE’s for Current year and possibly up to 3 years prior, Disabled Veteran Exemptions for current year only, Poverty Exemptions for current year only – No Assessment Appeals will be heard.

Tuesday, December 10, 9:00 AM

Clerical errors and mutual mistakes of fact, PRE’s for Current year and possibly up to 3 years prior, Disabled Veteran Exemptions for current year only, Poverty Exemptions for current year only – No Assessment Appeals will be heard.

- Public Notice 2024

- Board of Review Forms

* 2023 Board of Review and Key Topics Course List

- Form 5731 – Assessing District Required Board of Review Training Report

- Bulletin 18 of 2021 – 2022 Boards of Review

- Form 5511, Application to Request Board of Review Member Training Program Material

- Audit of Minimum Assessing Requirements

- General Property Tax Act (PA 206 of 1893)

- Supervising Preparation of the Assessment Roll

- Board of Review Q & A

- Guide to Basic Assessing

- Property Classification Q & A

- Disabled Veterans Exemption FAQ

- Essential Services Assessment FAQ

* Qualified Agricultural Property Exemption Guidelines

If you have questions regarding your Notice of Assessment or to schedule an appointment with the BOR, you may contact our assessing department during regular business hours.

Click here to view assessing records. On the left of the AccessMyGov Fort Gratiot page, click Assessing Search. A bar near the top of the page will appear. Enter the address of the property you are searching for and click SEARCH on the right. On the next screen click the property address and you will be taken to the Record Details page.

F.A.Q.’S

Can a Board of Review set the SEV or Assessed Value at the sales price of the property? No. This practice is illegal in Michigan. An individual sale price IS NOT the same as True Cash Value of the Property due to a variety of reasons, including among those an uninformed buyer, an uninformed seller, insufficient marketing time, buyer and seller are relatives, and other reasons.

Section 27(5) of the General Property Tax Act states the following: “Beginning December 31, 1994, the purchase price paid in a transfer of property is not the presumptive True Cash Value of the property transferred. In determining the True Cash Value of transferred property, an assessing officer shall assess that property using the same valuation method used to value all other property of the same classification in the assessing jurisdiction.”

Therefore, a Board of Review does NOT have the authority to change an assessment based on a sale price.

Is this what the State Tax Commission means when it says a Board of Review or Assessor cannot “follow sales”? Yes. “Following sales” is defined in the assessor’s manual as the practice of ignoring the assessment of properties, which have not recently been sold, while making significant changes to the assessments of properties which have been sold. The practice of “following sales” is a serious violation of the law. The practice of following sales results in assessments that are not uniform.

What is Proposal A? On March 15, 1994 the voters of the State of Michigan approved Proposal A. Prior to Proposal A, property taxes were based on STATE EQUALIZED VALUE. Proposal A established TAXABLE VALUE as the basis for calculation of property taxes.

What is Assessed Value and is it still important? Michigan law requires that all property be uniformly assessed at 50% of the usual selling price, or sometimes called the True Cash Value. Each year, assessors must still prepare an assessment roll that contains “traditional” Assessed Valuations at 50% of True Cash Value.

What is Taxable Value? Except when there is a transfer of ownership in the prior year, Taxable Value for a parcel of property is the LOWER of STATE EQUALIZED VALUE for the parcel, or the CAPPED VALUE for the parcel.

What is State Equalized Value? State Equalized Value or SEV is the Assessed Value, as adjusted following State and County Equalization.

What is Capped Value? Capped Value is calculated by adjusting the prior year Taxable Value of the property by any additions or losses and multiplying by the inflation rate multiplier (IRM). The IRM is calculated based on statute and cannot be greater than 1.05 (1 + 5%).

The Capped Value formula is: (Prior Year Taxable Value – Losses) x (IRM) + Additions.

What is the Inflation Rate Multiplier and how is it calculated?

INFLATION RATE is defined in the Statute as the ratio of the general price level for the state fiscal year ending in the calendar year immediately proceeding the current year divided by the general price level for the state fiscal year ending in the calendar year before the year immediately proceeding the current year.

The Statute also defines GENERAL PRICE as the annual average of the 12 monthly values for the United States consumer price index for all urban consumers as defined and officially reported by the United States Department of Labor, Bureau of Labor Statistics.

Based on this statutory requirement, a sample calculation for 2013 is as follows:

A. The 12 monthly values for October 2011 through September 2012 are averaged.

B. The 12 monthly values for October 2012 through September 2013 are averaged.

The ratio of B divided by A is calculated and this becomes the IRM.

The Inflation Rate Multiplier (CPI) for 2014 is 1.6%. This means that the taxable value for your property will increase by 1.6%. Physical changes in your property may also increase or decrease your Taxable Value. Changes in the State Equalized Value due to Market Value changes may also affect the Taxable Value, since the Taxable Value cannot be higher than the State Equalized Value.

Does the Board have any authority over Capped Values? STC Bulletin No. 14 of 1994 states: an assessment roll must contain the Capped Value for each parcel of real property.

If correct figures have been used in the Capped Value formula for the prior year Taxable Value and for the current Inflation Rate Multiplier, the Board of Review cannot make a change that results in a different capped value of the property.

The Board of Review may change the amount of the Losses and Additions used in the Capped Value formula, if they determine they are improper. Only factual information will be used to amend the Losses or Additions in the Capped Value formula.

STC Bulletins 3 of 1995, 18 of 1995, and 3 of 1997, address the procedures required by law for determining the amount of Losses and Additions for calculation of the cap on Taxable Value. (Note: an increase in value due to an increase in a property’s occupancy rate is not a legal addition in the Capped Value formula.)

What is Uncapping? When a property transfers ownership as defined by law, the property’s Taxable Value uncaps the following year. A property on which “Transfer of Ownership” occurred shall have its Taxable Value uncapped the following year. For example, a property that transferred in 2013 will have the 2014 Taxable Value equal to its 2014 SEV. A Question and Answer document regarding many common Transfer of Ownership questions is available at www.michigan.gov/treasury.

Does the Property then “recap”? The growth in Taxable Value of transferred properties will then be capped again in the second year following the “Transfer of Ownership”

What are the authorities of the Board of Review over transfers of ownership and uncapping? The assessor of each Township and City is required by law to review all of the transfers and conveyances, which occurred in the prior year and determine which of these transfers and conveyances, are “Transfers of Ownership”.

The determination by the assessor that a particular transfer or conveyance is a “Transfer of Ownership” and that the property’s Taxable Value should be uncapped is subject to review by the March Board of Review either on the Board’s own initiative or at the request of a property owner.

Public Act (PA) 23 of 2005 granted the July or December Board of Review the authority to correct the Taxable Value of property which was previously uncapped (due to a perceived transfer of ownership) if the assessor later determines there had NOT been a transfer of ownership of that property after all. This authority applies to the current year and the 3 immediately preceding years. Bulletin 9 of 2005 provides more detailed information.

State Tax Commission Bulletin No. 19 of 1997

DATE: December 12, 1997

TO: Assessing Officers, Equalization Directors

FROM: State Tax Commission (STC)

RE: THE ILLEGAL PRACTICES OF: A) “FOLLOWING SALES”

The State Tax Commission is very concerned about reports that some assessors have engaged in the illegal practices of “following sales” and assessing over 50% of true cash value.

The purpose of this bulletin is to provide instruction to assessors regarding these illegal practices.

- A. “Following Sales”

“Following sales” is described in the State Tax Commission Assessor’s Manual as the practice of ignoring the assessments of properties which HAVE NOT RECENTLY SOLD while making significant changes to the assessments of properties which HAVE RECENTLY SOLD.

“Following sales” can also be described as the practice of assessing properties which HAVE RECENTLY SOLD significantly differently from properties which HAVE NOT RECENTLY SOLD.

Article IX, Section 3 of the State Constitution states that “The legislature shall provide for the UNIFORM general ad valorem taxation of real and tangible personal property …” This requirement has NOT changed as a result of Proposal A.

Section 27(5) of the General Property Tax Act states the following:

“In determining the true cash value of transferred property, an assessing officer shall assess that property using the same valuation method used to value all other property of that same classification in the assessing jurisdiction.”

The following example illustrates the illegal practice of “following sales”.

EXAMPLE: An assessor has been notified by the equalization department that the starting base for the residential class in his/her unit is 45.45%. This means that it is necessary for the assessor to increase the residential class overall by about 10% in order to avoid a factor. It is the assessor’s responsibility to determine where this increase should be spread in order that all properties are assessed at 50%.

It would be illegal for the assessor to generally increase properties which have recently sold by say 25% while increasing all other properties in a neighborhood by say 5%. This would be an example of the illegal practice of “following sales”.

“Following sales” is both UNCONSTITUTIONAL AND ILLEGAL. An exception would occur where an assessor inspects a property after a transfer of ownership and discovers that there is omitted property such as a garage which was built in the past but was not included in the assessment and was not noted on the assessment card. In this case the assessor must include the omitted property in the assessed value for the year following the transfer of ownership.

If the assessor is doing a proper job of assessing all properties uniformly at 50% of true cash value each year, there is no reason to assess properties which have sold any differently from properties which have not sold.

In a related matter, some assessors believe that Proposal A requires that, in the year following a transfer of ownership, the assessed value of a property which has transferred must automatically be set at 1/2 of the sale price. Proposal A does NOT authorize the assessor to AUTOMATICALLY set the assessed value of a property which has sold at 1/2 of the sale price. An individual sale price may NOT be a good indicator of the true cash value of the property due to a variety of reasons (such as an uninformed buyer, an uninformed seller, insufficient marketing time, buyer and seller are relatives, and other possible reasons).

BUILDING DEPARTMENT

Fort Gratiot, Michigan 48059

Office: (810) 385-4489, ext.1112

Facsimile: (810) 385-9010

Email: buildingclerk@fortgratiot.us

Office Hours: Monday – Friday, 8:00 am – 4:30 pm (lunch 12:30ish-1:30ish)

| It is the goal of Fort Gratiot Township Building Department to make the process of obtaining permits user friendly. To achieve this goal, we need full cooperation from both contractors and homeowners so we can better work together. For your convenience, we’ve listed some of the guidelines below which outline the process: |

| DOCUMENTS TO BE PROVIDED BY CONTRACTOR |

DOCUMENTS TO BE PROVIDED BY APPLICANT (HOMEOWNER/CONTRACTOR) |

| 1. Picture I.D. | 1. Residential: Two (2) complete sets of prints; Commercial: Three (3) complete sets of prints. Building Dept will retain one full set of prints and will return the additional sets to the applicant upon permit issuance. |

| 2. Proof of license | 2. Driveway/Culvert Permit obtained from the SCC Road Commission (if applicable) |

| 3. Proof of Liability Insurance | 3. EGLE High Risk Erosion Permit and/or Wetland Assessment (if applicable) |

| 4. Federal I.D. Number | 4. Address Application (if applicable) |

| 5. Health Department approval for well/septic and/or Soil Erosion and Sedimentation Control (if applicable) | |

| 6. Site Plan approval (if required by Planning Commission – see Zoning Administrator) | |

| 7. FEMA Flood Zone construction (if applicable): Letter of Map Amendment (LOMA) or professional elevation survey reflecting that the construction location is above flood zone levels. If the proposed work is below the minimum flood zone level, prints must reflect that the construction will meet flood zones standards. | |

| 8. Professional survey reflecting existing structures, proposed construction, setbacks, etc., as required. | |

After the permit is issued, inspections will need to be conducted by our inspectors at the request of the permit holder. Please contact Courtney at (810) 385-4489, ext. 1112 to schedule all inspections. Please call 24 hours in advance as our inspectors are part-time. They each attend continuing education classes throughout the year and may not be available.

|

| BASIC STEPS OF BUILDING PERMIT APPLICATION PROCEDURE: |

| 1. Applicant fills out application in full for submittal. |

| 2. Applicant submits all paperwork required for approval (see above items) |

| 3. Residential: Two (2) full sets of plans with all structural information completed. |

| 4. Commercial: Three (3) full sets of plans with all structural information completed. If the job is in Birchwood Mall located at 4350 24th Ave, the plans must be signed and sealed with stamped approval of the mall. Unit number must be reflected on the permit application. |

| 5. Applicant allows 10-21 business days for plan review to be completed by the inspectors and 7-15 business days for permit application approval. |

| 6. The applicant will be notified of the plan review results and when the permit is ready for payment and issuance. |

| INSPECTIONS (MUST PHONE 24 HOURS IN ADVANCE) | |

| ELECTRICAL INSPECTIONS | BUILDING INSPECTIONS |

| 1. Service | 1. Ground Water Investigation (at time of excavation) |

| 2. Rough Electrical | 2. Footing (Before the pour of concrete) |

| 3. Final | 3. Foundation/Basement |

| 4. Backfill | |

| 5. Floor Joist/Decking | |

| 6. Rough Framing | |

| 7. Insulation | |

| 8. Drywall nail pattern before tape & mud (Commercial only) | |

| 9. Temporary or Final Occupancy | |

|

*NOTE: ADDRESSING MUST BE DISPLAYED ON PROPERTY BEFORE FINAL CERTIFICATE OF OCCUPANCY IS ISSUED. |

|

| For certain types of construction, not all inspections above will apply. In order to keep construction progressing, it is very important that all required inspections are conducted. Inspection histories are computerized so if you need to know when an inspection was performed, the information can be obtained by a quick phone call to the Building Department.

Setting up an inspection is quick and easy: 1. Call the Building Department (810) 385-4489, ext. 1112. 2. Give the property address, permit number and the best time frame the inspector can access the jobsite. We realize that it is sometimes difficult to predict when you will be ready for an inspection, but please call 24 hours in advance as our inspectors are part-time. |

|

Temporary Occupancy “To Stock Only” This certificate is usually only issued if there is work that is incomplete to the point where the site would be unsafe to occupy, but is finished enough to move belongings in. For example, a moving company delivering furniture or a commercial store stocking shelves. Final Certificate of Occupancy “Final C of O” The Final Certificate of Occupancy is issued by the building inspector. Before the building inspector is contacted, you must have final approval from the electrical, mechanical and plumbing inspectors. The last step will be to call the Building Department to request Final Occupancy, which will allow you to move into your new home or business. If Fire Department inspections are required for occupancy, the Building Department will schedule them accordingly. |

Current Codes pursuant to Ordinance 206, effective July 12, 2011

ARTICLE II. SINGLE STATE CONSTRUCTION CODE

Sec. 4-31. Adoption.

The Michigan Building Code, the Michigan Residential Code, the Property Maintenance Code, the Michigan Uniform Energy Code, the Michigan Plumbing Code, the Michigan Mechanical Code and the National Electrical Code, pursuant to Public Act 230 of 1972, are hereby adopted by reference, as amended.

Sec. 4-32. Agency Designated.

Pursuant to the provisions of the single state construction code, in accordance with Public Act 230 of 1972 (MCL 125.1501 et. seq.) as amended, the Charter Township of Fort Gratiot assumes responsibility for the administration and enforcement of the state codes throughout its corporate limits.

Sec. 4-65. Numerals.

Each posted address shall consist of numerals at least four inches in height and of a contrasting color to the attached surface. Address numbers shall be Arabic numerals or alphabet letters.

Chapter 4, Buildings and Building Regulations, Section 4-67 (4), of the Code of Ordinances, Charter Township of Fort Gratiot, Michigan, is hereby created to read as follows:

(4) Display of Street Address of Premises on Signs.

The street address number shall be displayed on the primary freestanding identification sign for each premises on land located in Office (O-1, O-2), Neighborhood Business (C-1), General Business (C-2), Light Industrial (M-1) or Heavy (M-2) districts, as shown on the Fort Gratiot Charter Township Zoning Map. Display of street address numbers shall conform to the following standards:

- The height and style shall be in accordance with Sec. 4-65, herein.

- Address numbers shall be displayed on the sign face or on the supporting structure of the sign, at a minimum height of two (2) feet above grade.

- If the premises which are identified by a primary freestanding identification sign contains more than one street address number, the street address number displayed on the sign shall identify the lower and upper ends of the address range to which the sign pertains.

- Display of street address numbers on a sign structure shall not be considered a sign subject to the maximum area regulations.

Chapter 14, Fire Prevention and Protection, Section 14-31 (a) and Section 14-32 (a) of the Code of Ordinances, Charter Township of Fort Gratiot, Michigan, is hereby amended to read as follows:

Sec. 14-31. Adoption of International Fire Code.

(a) A certain document, a copy of which is on file in the office of the fire department, being marked and designated as the International Fire Code, as published by the International Code Council, is hereby adopted by reference as the fire code of the township, regulating and governing the safeguarding of life and property from fire and explosion hazards arising from the storage, handling and use of hazardous substances, materials and devices, and from conditions hazardous to life or property in the occupancy of buildings and premises as provided in this section; providing for the issuance of permits and collection of fees; and each and all of the regulations, provisions, penalties, conditions and terms of such fire code on file in the office of the township are hereby referred to, adopted and made a part hereof, as if fully set out in this section, with the additions, insertions, deletions and changes, if any, prescribed in this section.

Chapter 14, Fire Prevention and Protection, Section 14-32 of the Code of Ordinances, Charter Township of Fort Gratiot, Michigan, is hereby deleted in its entirety.

PLANNING & COMMUNITY DEVELOPMENT

CHAPTER 38. ZONING

ARTICLE III. DISTRICT REGULATIONS

DIVISION 1. GENERALLY

Section 38-112 District Boundaries

THE CHARTER TOWNSHIP OF FORT GRATIOT ORDAINS:

SECTION 1. PURPOSE

The purpose of this Ordinance is to amend the official zoning map of the Charter Township of Fort Gratiot.

SECTION 2. AMENDMENT

The Charter Township of Fort Gratiot Code of Ordinances, Chapter 38, Zoning, Article III, District Regulations, Division 1, Generally, Section 38-112 District Boundaries, official zoning map, is hereby amended to reflect the district boundary changes as follows:

That property situated in the Charter Township of Fort Gratiot, St. Clair County, Michigan and more specifically described as:

| PARCEL 1: | 74-20-016-2004-000 | ADDRESS: | Vacant lot, Carrigan Road |

| LEGAL DESCRIPTION AND AREA REZONED: | West 5 Acres of East 10 Acres of NW ¼ of NE ¼. SECTION 16. T7N R17E. 5.00 Acres | ||

| PARCEL 2: | 74-20-016-2005-000 | ADDRESS: | Vacant lot, Carrigan Road |

| LEGAL DESCRIPTION AND AREA REZONED: | East 5 Acres of NW ¼ of NE ¼. SECTION 16 T7N R17E 5.00 Acres | ||

| PRIOR DISTRICT: | AG Agricultural | NEW DISTRICT: | R-2 Two Family Residential |

is hereby rezoned from AG Agricultural to R-2 Two Family Residential, as specified above, and the official zoning map is changed accordingly.

SECTION 3. SEVERABILITY

If any provision of this Code or its application to any person or circumstances is held invalid or unconstitutional, the invalidity or unconstitutionality does not affect other provisions or application of this Code that can be given effect without the invalid or unconstitutional provision or application, and to this end the provisions of this Code are severable. If any provision of this Code or its application to any person or circumstance is held to be over broad, that provision or application will nevertheless be enforced to the fullest extent permitted by law.

SECTION 4. REPEAL

All Ordinances in conflict, herewith, are, hereby, repealed.

SECTION 5. EFFECTIVE DATE

This Ordinance shall become effective seven days after the publication of adoption.

SECTION 6. INSPECTION OF ORDINANCE

A copy of this Ordinance may be inspected or purchased at the Township Hall, 3720 Keewahdin Road, Fort Gratiot, Michigan 48059, during regular posted office hours, and online at fortgratiot.us.

The following events and dates occurred or are scheduled to occur for the adoption of this Ordinance:

| FORT GRATIOT PLANNING COMMISSION PUBLIC HEARING: | TUESDAY, DECEMBER 12, 2023 |

| SCC METROPOLITAN PLANNING COMMISSION REVIEW: | WEDNESDAY, JANUARY 21, 2024 |

| BOARD OF TRUSTEES INTRODUCTION APPROVED: | WEDNESDAY, FEBRUARY 7, 2024 |

| DATE POSTED IN CLERK’S OFFICE AND FORTGRATIOT.US: | THURSDAY, FEBRUARY 8, 2024 |

| DATE PUBLISHED IN PORT HURON TIMES HERALD: | MONDAY, FEBRUARY 12, 2024 |

| BOARD OF TRUSTEES DATE ADOPTED AFTER INTRODUCTION: | WEDNESDAY, FEBRUARY 21, 2024 |

| DATE PUBLISHED AFTER ADOPTION: | MONDAY, FEBRUARY 26, 2024 |

| DATE EFFECTIVE-SEVEN DAYS AFTER PUBLICATION: | TUESDAY, MARCH 5, 2024 |

St. Clair County Metropolitan Planning Commission Review Rezoning Ordinance 230

Fort Gratiot Planning Commission Rezoning Review Ordinance 230

Links and Information

Portside Solar Status 11-14-2023 – We will continue to monitor and update information on the Portside Solar proposal.

Click here for the current Zoning Map

Click here for the Fort Gratiot Master Plan 2020-2025

Click here for the current Fort Gratiot Street Map

Code of Ordinances: http://library.municode.com/index.aspx?clientId=13743

Following are ordinances that have been added or updated and are effective, but are not online yet:

Click here for Permitted Exterior Materials (Ordinance No. 184)

Click here for Planned Shopping Center Regulations (Ordinance No. 185)

Click here for Signs (Ordinance No. 207)

Click here for the C-2 General Business District Regulations (Ordinance No. 211)

Click here for the Solar Energy Systems Ordinance

St. Clair County Drain Commissioner Rules – Effective 10/01/2018

PLANNING COMMISSION

The Planning Commission meets on the second Tuesday of each month in the Fort Gratiot Municipal Center Gardendale Meeting Room, beginning at 7 PM. The Planning Commission must meet a minimum of four times per year, so please contact this office or visit the website for the agenda. If there are no proposals for the PC to review, a meeting may be cancelled. Click here to view 2024 Planning Commission information

DEPARTMENT OF PUBLIC WORKS

Department of Public Works

Greg Randall, DPW Superintendent

Office: (810) 385-4489 ~ Facsimile: (810) 385-9010

After Hours Emergency: 810-650-0208 or 810-650-3119

WATER/SEWER RATES

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

There a few pieces of information required to calculate the cost, whether you are calling us or estimating on your own:

- The gallons of water your pool holds

- If you have water only (with a septic field) or water and sewer

- Our current water and sewer rates

On the home page, under Quick Links on the left, there is a link for Utility Billing Search & Pay (or click here) where you can enter your account name or address to view the current bill and a history of prior bills. This may help to compare the current quarter to see what you have previously paid for the same time period and whether you are a water and sewer customer or if you are a water only customer.

Now that you have the info, above, you are ready to call us or estimate on your own.

To estimate on your own, first convert the number of gallons your pool holds into cubic feet. To do this, multiply the number of gallons by 0.1337 to obtain cubic feet (c.f.).

- Example: 25,000 gallons x .1337 = 3,342.50 cubic feet.

Next, take your calculated cubic feet and divide by 1000 to get the MCF (per 1000 c.f.)

- Example: 3,342.50 c.f. divided by 1,000 = 3.34250 MCF

Now multiply that figure by the current applicable rate(s).

- Example-Water customer only: 3.34250 x $42.75 (current water rate) = $142.89 for the water cost

- Example-Water & sewer customer: 3.34250 x $38.50 (current sewer rate) = $128.68 plus the $142.89 for water = $271.57

Generally the costs for filling your pool through your tap can be less expensive than a delivery service, but it can take hours to accomplish. If you choose to fill your pool on your own, you may have decreased water pressure while your hose or hoses are filling. Our Fire Department and DPW do not fill pools with our tankers; and in no instance should anyone turn on a fire hydrant for personal use.

ELECTIONS

2024 ELECTIONS

Presidential Primary – Tuesday, February 27, 2024

Special Election – Tuesday, May 7, 2024

Primary Election – Tuesday, August 6, 2024

General Election – Tuesday, November 5, 2024

Polls are open from 7:00 AM until 8:00 PM on each election day.

With the passage of Proposal 22-2, for statewide and federal elections, in-person early voting is available nine consecutive days beginning on the second Saturday prior to the election and ending the Sunday prior to the election. Dates and times for early voting will be posted here. More detailed information is below.

For more information from the State of Michigan, click here to be redirected to the Secretary of State Voter Information Center

For more information from the St. Clair County Clerk, click here to be redirected to the St. Clair County Clerk’s Office Elections website.

Elections administration is handled by the elected Clerk and appointed Deputy Clerk, as required by state statute. The Clerk’s office is located in the Fort Gratiot Municipal Center, 3720 Keewahdin Road, Fort Gratiot, Michigan 48059. The Clerk’s office is open Monday through Friday, 8:00 AM – 4:30 PM. Generally, break periods are staggered and someone is in the office. However, if you need to speak with someone in person, we recommend contacting the office to make an appointment.

Clerk Robert D. Buechlerrbuechler@fortgratiot.us(810) 385-4489 x 1104 |

Deputy Clerk Vicki Ostrandervostrander@fortgratiot.us(810) 385-4489 x 1103 |

REGISTER TO VOTE

Voters can check their voter registration status here: Michigan Secretary of State Voter Registration Lookup

Michigan voters are encouraged to register as early as possible before an election. Methods and requirements for voter registration depend on the following deadlines:

- 15+ days before an election: voters can register online, by mail, or in person.

- 14 days or less prior to an election, and on Election Day: voters may only register by visiting their local clerk’s office to register in person with proof of residency documentation.

IN PERSON-CLERK’S OFFICE. Fort Gratiot residents may register in-person during regular business hours at the Fort Gratiot Municipal Office, 3720 Keewahdin Road, Fort Gratiot, Michigan 48059. If you would like to set a specific time to register with the Clerk or Deputy Clerk, please call (810) 385-4489. You may, but are not required to, complete and print the form prior to coming to the office, found here: Michigan Voter Registration Form. If registering 0-14 days prior to an election, voters must register in-person at the Clerk’s office and must provide proof of residency. Click here for a list of acceptable documents.

ONLINE. To register online, you must have a current Michigan Driver’s License or Personal Identification Card and qualify to vote in the state of Michigan: Register Online.

BY MAIL. If your current address is within Fort Gratiot, return your form to the Clerk’s office at the Fort Gratiot Municipal Office, 3720 Keewahdin Road, Fort Gratiot, Michigan 48059. Click on this link to obtain a form: Michigan Voter Registration Form.

OTHER AGENCIES. There are local agencies that may also provide voter registration services to their clients, including the Council on Aging, Department of Human Services, Department of Community Health and Military Recruitment Centers.

CHANGE YOUR ADDRESS. If you have moved, you can your change your driver’s license, personal ID and voting address by visiting the Secretary of State’s website at: www.michigan.gov/vote.

ABSENTEE VOTING

Absentee voter (AV) ballots are available for all elections, providing voters with an alternate method for casting a ballot when they are unable to attend the polls, or if they prefer to vote at home and return the ballot to the Clerk’s office.

ABSENTEE BALLOT REQUEST. If you would like to request an absentee ballot for a single election, please complete the Absent Voter Ballot Application and return to the Clerk’s office, or apply online here: Online Absentee Ballot Request

A voter must submit an absentee ballot application before an absentee ballot can be sent. Voters can request an absentee ballot up to 75 days before an election by submitting a completed absentee ballot application to their local clerk. Absentee ballots are available and distributed beginning 40 days before the election.

Michigan voters can decide to be placed on a permanent absentee ballot list. Their local clerk will then mail them an absentee ballot.

For information on military and overseas absentee voting, visit the military and overseas voting section.

PERMANENT ABSENTEE BALLOT LIST. If you prefer to vote absentee and receive your ballot in the mail, consider signing up to be on the permanent list. Placement on this list means that you will automatically receive your ballot in the mail approximately 40 days prior to all scheduled local, state, and federal elections to the address our office has on file. A signed request is required if you would like to be placed on this list. If interested, please complete the form and check the box in section 2 under Other Elections: Absent Voter Ballot Application

RETURNING BALLOTS. Ballots must be received in the Fort Gratiot Clerk’s office no later than 8:00 PM on election day to be counted, though we encourage voters to return ballots as soon as possible. Remember to sign the envelope provided or the ballot cannot be counted. Someone in your immediate family or living in your household can help you deliver this application. If that’s not possible, you can ask any Michigan registered voter to deliver it for you. The person helping you must sign “Certificate of Authorized Registered Elector Returning Absent Voter Ballot Application” on the envelope. Voters may return their voted ballots by mail (state-funded return postage is included,) in-person or by using our secure ballot drop box, located in front of the FGMC.

TRACK YOUR ABSENTEE BALLOT. Click this link to view the status of your application and/or ballot: Track Your Absentee Ballot

EMERGENCY BALLOTS. If an emergency, such as a sudden illness or family death prevents you from reaching the polls on election day, you may request an emergency absent voter ballot. Requests must be submitted after the deadline for regular absent voter ballots has passed, but before 4:00 p.m. on election day. The emergency must have occurred at a time which made it impossible for you to apply for a regular absent voter ballot. Please contact the Clerk’s office for more information about emergency absent voter ballots.

EARLY IN-PERSON VOTING

Both early in-person voting and absentee voting allow voters to cast a ballot prior to Election Day. However, there are key differences between the two methods of voting.

- Early voting allows voters to cast a ballot similar to how they would do so at a polling place on Election Day. Voters are issued a ballot and can personally insert it into the tabulator at their early voting site.

- Absentee voting allows voters to request a ballot by mail or in person at their local clerk’s office. Voters can complete their absentee ballot at home or at their local clerk’s office and submit it in an envelope by mail, in person, or by drop box. After an absentee ballot is received by the local clerk, the voter’s absentee ballot is processed and tabulated by their local clerk.

Absentee voters also have more flexibility to “spoil” their ballot, or change their vote, after it has been submitted.

VOTER ASSISTANCE EQUIPMENT

WORK AS AN ELECTION DAY INSPECTOR!

The Fort Gratiot Clerk’s Office is looking for people to work the polls on Election Day. By serving as an Election Inspector, also referred to as a poll worker, residents can serve their community, see their neighbors, be engaged in the democratic process and earn extra income at the same time!

Each county, city, and township in Michigan hires and pays election inspectors for the early voting period and on Election Day. Election inspectors are hired, paid, and trained local government workers who assist with running local elections in compliance with Michigan Election Law.

Inspectors will be stationed at one of the 4 precincts throughout Fort Gratiot and will be responsible for opening the precinct on Election Day, ensuring voters are registered and are voting in the proper precinct, assigning ballots and closing the polls. Election Inspectors are paid for working on Election Day and also receive additional payment for attending mandatory training prior to Election Day. Election Inspectors must be a qualified and registered elector of the State of Michigan.

Interested in becoming an Election Inspector? Contact the Clerk’s office today! Election Inspector Application

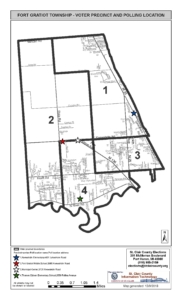

VOTING PRECINCTS

A few changes and consolidations were made in 2020, including the closure of Precinct 5, the Pointe Community Center. To verify your current registration info, you may contact the Clerk’s office or check online, here: Voter Registration Lookup

Precinct 1: Keewahdin Elementary, 4801 Lakeshore Road

All voters living on the north side of Brace Road between Parker Road and State Road, all EVEN addresses between 3728-3998 Brace Road, vote in Precinct 1, at Keewahdin Elementary School.

All voters living on the East Side of State Road from between Brace Road and Metcalf Road, all EVEN addresses between 5514-5802 State Road, will vote in Precinct 1, at Keewahdin Elementary School.

Precinct 2: Fort Gratiot Middle School, 3985 Keewahdin Road

Precinct 3: Fort Gratiot Municipal Center, 3720 Keewahdin Road

Precinct 4: Thomas Edison Elementary, 3559 Pollina Avenue

Former Precinct 5, the Pointe Community Center, was consolidated with Precinct 1, and votes at Keewahdin Elementary. Follow this link for the full 2020 Precinct Changes and March 2020 Election Information

INFORMATION FOR CANDIDATES RUNNING FOR TOWNSHIP OFFICE

Candidates wishing to be on the ballot for public offices in Fort Gratiot must file original documents no later than 4:00 p.m. on the 15th Tuesday before the August election. For this term, the deadline for the August 6, 2024 Primary Election is 4:oo p.m. on April 23, 2024. The complete packet of forms is available in the Clerk’s Office.

Candidates for the following positions file receive forms and file with the Fort Gratiot Clerk’s Office:

- Fort Gratiot Supervisor

- Fort Gratiot Clerk

- Fort Gratiot Treasurer

- Fort Gratiot Trustee (four positions)

- Fort Gratiot Park Commissioner (five positions)

Every candidate must submit the following forms, which are available by contacting Clerk Robert Buechler at (810) 385-4489 x 1104 or rbuechler@fortgratiot.us. Because incomplete or incorrect forms cannot be accepted late, candidates are strongly encouraged to submit the packet prior to the deadline so that any necessary corrections can be made to ensure the candidate is included on the ballot.

- Affidavit of Identity

- Nominating Petitions with sufficient signatures, or, in lieu of petitions, a $100 non-refundable filing fee, made payable to Fort Gratiot Township.

- Statement of Organization(If you plan on expending or receiving over $1,000 you must also file required campaign finance reports.)

FIRE DEPARTMENT

Emergency: 911

Office: (810) 385-5666

Fax: (810) 385-7813

Email: fgfd@fortgratiot.us

Burning permits are required for all burning and can be obtained on an annual (January-December) basis free of charge at the fire department. Please call for more information.

The burning of leaves and building materials is prohibited.

Current Applicable Fire Code, adopted in Ordinance 206, effective July 12, 2011

Sec. 14-31. Adoption of International Fire Code.

(a) A certain document, a copy of which is on file in the office of the fire department, being marked and designated as the International Fire Code, as published by the International Code Council, is hereby adopted by reference as the fire code of the township, regulating and governing the safeguarding of life and property from fire and explosion hazards arising from the storage, handling and use of hazardous substances, materials and devices, and from conditions hazardous to life or property in the occupancy of buildings and premises as provided in this section; providing for the issuance of permits and collection of fees; and each and all of the regulations, provisions, penalties, conditions and terms of such fire code on file in the office of the township are hereby referred to, adopted and made a part hereof, as if fully set out in this section, with the additions, insertions, deletions and changes, if any, prescribed in this section. Chapter 14, Fire Prevention and Protection, Section 14-32 of the Code of Ordinances, Charter Township of Fort Gratiot, Michigan, is hereby deleted in its entirety.

Chief Fronimos started his 34 years in emergency services in Michigan in 1989 working for the Wayne County Executive as an Administrative Assistant, Press Aide and Emergency Management Public Information Officer. He attended Schoolcraft College becoming certified as a Firefighter 1-2 and emergency medical technician. He worked at departments in Oakland and Macomb counties before moving to Kentucky in 1997. Chief Fronimos volunteered with the City of Florence, Kentucky Fire Department for eight years, becoming an apparatus operator/engineer, fire investigation team member and gaining valuable experience on a busy combination department.

In 1999, Chief Fronimos was hired full-time with the Hebron Fire Protection District in Northern Kentucky, a suburb of Cincinnati, Ohio. He was promoted to apparatus operator/engineer where he served until 2017. He was also the public education coordinator, public information officer and founded the high school explorer program as well as the chaplains corps. He also coordinated the bi-annual open house which drew visitors from numerous states and the attendance broke records each year, topping over 7,000. In 2003, Chief Fronimos’ public education program was recognized as the best program throughout the greater Cincinnati (KY-OH-IN) region earning the title of “Firehouse of the Year.”

Chief Fronimos was recruited and hired in 2017 as a Battalion Chief with the Williston, North Dakota Fire Department in the oil boom region of western ND. For 2 1/2 years he was able to help build the department and recruit other members, and served as the department’s public information officer. The department grew quickly just like the city, where his shift expanded from 14 personnel to 22 personnel before he departed. His responsibility was overseeing four firehouses, which included three structural and one airport.

One of the largest fires in the history of the city occurred on Chief Fronimos’ watch in 2017, just three weeks on the job where a 100-year old historic department store caught fire in the late afternoon. Through the leadership and experience of Chief Fronimos, the initial operations and tactics prevented the loss of life of two firefighters and the spread of the fire. Upon arrival of the fire chief and assistant chief, they kept Fronimos in command of the entire incident and was also used as a mentoring moment by the leadership team. This proved fruitful for Chief as he continued to grow in the role as chief officer.

He was lured away from North Dakota (strongly encouraged by his wife) to become Assistant Fire Chief in 2019 with the Wytheville Fire Rescue Department in Virginia. It was there that Chief Fronimos was able to spread his wings and implement new initiatives, despite the Covid pandemic. While only serving there for 18 months, he was instrumental in hiring 16 personnel – doubling the size of the organization, but also in initiating a fire hydrant management program, fire inspection program, pre-plan technology improvements and more. He was active in the community but eventually moved back to greater Cincinnati to be instrumental in his young son’s life. He continued serving with the Dry Ridge Fire Department in Kentucky until he retired in 2023. Obviously, retirement didn’t suit Chief Fronimos’ taste buds.

In 2022, he began working/driving rideshare in greater Cincinnati where he encountered over 3,000 riders in less than two years. He created a Facebook page to share his inspirational stories and pictures and is now working on a book about his rideshare adventures across Kentucky, Ohio, and Indiana.

He is well respected across the United States and beyond in the public safety community as an instructor, speaker, and leader. Chief Fronimos has been an instructor at the prestigious Fire Department Instructor Conference in Indiana for ten years and was an active instructor across Indiana and Kentucky for nearly twenty years teaching Live Fire Training in accordance with NFPA 1403 guidelines. A decorated firefighter, he has earned the title of Firefighter of the Year three times (1994-Royal Oak Twp., MI, 1998-City of Florence, KY, 2003-Hebron, KY) as well as several other honors. In 2006, he was recognized by Kentucky Governor Ernie Fletcher and given the distinct honor of being commissioned a Kentucky Colonel. One his most cherished honors was being selected as a Lifetime Member of the Williston Fire Department – the first career member to receive this honor and also the first with less than ten years of service. Chief cherishes the opportunity to come back home to Michigan, sharing with his son the things that makes Michigan so special and to enjoy father-son time.

Born and raised on the westside of Detroit, Chief Fronimos grew his passion and love of the fire service after his mother took him to their local firehouse, Engine 55/Ladder 27 of the Detroit FD. This spawned a love of “the Job” and life of service to others; a passion and trait that he has passed along to his 10-year old son. A divorced single father, he inspires his son with strong work ethic, faith in God and the love to help others. Chief Fronimos and his son, Mickey are avid Tigers, lions, and Red Wings fans and are looking forward to attending more games. You may even catch Chief and Mickey at the Big House for a Michigan football game this fall! Chief shared, “Mickey loves, loves, loves, the Detroit Lions and I can’t wait to share that enjoyment with him as well. We are also Cincinnati Bengals fans but will always be true to the Lions first. We adopted the Columbus Blue Jackets because of the proximity to us, as well as our ECHL, Cincinnati, Cyclones, but the Detroit Redwings will always be our number one team overall.” They are excited to be members of the Fort Gratiot community and help to make a difference.

ORDINANCES AND REGULATIONS

Maps

Street Map

Thoroughfare Plan Map 2008-2030

General Regulations

Blight

Weeds & Noxious Weeds (tall grass) Ordinance

Operation of Off Road Vehicles on County Roads

Recreational Vehicle Regulations

Stables, Kennels and Farm Animals

Building and Development Regulations

C-2 General Business District Regulations

Temporary Outdoor Sales Ordinance

Fort Gratiot Master Plan 2020-2025

Click here to be redirected to the Code of Ordinances at www.municode.com The online codes are updated through Ordinance 186. The links above will take you to an updated section.

ZONING BOARD OF APPEALS

ATTENTION INTERESTED FORT GRATIOT RESIDENTS

THE ZONING BOARD OF APPEALS IS SEEKING A MEMBER FOR A TERM OF 01/01/2024-12/31/2026

The Fort Gratiot Charter Township Zoning Board of Appeals meets on the third Tuesday of each month, as needed, but no less than four times per calendar year, beginning at 7:00 PM, in the Gardendale Meeting Room at the Fort Gratiot Municipal Center (FGMC,) 3720 Keewahdin Road, Fort Gratiot, Michigan 48059.

The ZBA hears requests for dimensional variances, appeals of the zoning code, and requests for interpretation of the zoning code. Training opportunities are available, and members are compensated $100 per attended meeting.

Interested parties may submit a letter of interest to the Board of Trustees, in person or by mail to the FGMC or email at planning@fortgratiot.us no later than Tuesday, January 9, 2024. The appointment may be made at the January 17, 2024 Board of Trustees meeting.

If you have an questions, please contact the Office of Community Development at (810) 385-4489 x1113 or planning@fortgratiot.us.

Posted 12/20/2023

***

The ZBA meets on the third Tuesday of each month in the Fort Gratiot Municipal Center Gardendale Meeting Room, beginning at 7 PM. If no requests are received for the ZBA to take action, the meeting may be cancelled.

3720 Keewahdin Road

Fort Gratiot, Michigan 48059

Office: (810) 385-4489 x1113

Facsimile: (810) 385-9010

Email: planning@fortgratiot.us

SUPERVISOR’S OFFICE

Robert C. Crawford

Supervisor

Email: rcrawford@fortgratiot.us

Mailing Address: 3720 Keewahdin Road, Fort Gratiot, MI 48059

Phone: (810) 385-4489 x1100

Website: www.fortgratiot.us

Official Fort Gratiot Facebook: www.facebook.com/fgtwp

Core Competencies: The Building Blocks of Township Government

To ensure that all township officials have the opportunity to learn what they need to know to carry out their statutory duties as well as understand effective township management practices, the Michigan Townships Association has identified “core competencies.” Essentially, they are the “nuts and bolts” that each of the four elected offices at the township level should know and/or be skilled in to successfully perform their duties.

The list should not be construed as all-inclusive; rather they should be considered an overview of the knowledge and skill sets that an individual should possess. Note that each checklist is dynamic in the sense that it will change over time, adapting to legislation, legal issues, and other factors that impact township government and the responsibilities of the elected official.

The core competencies address two goals: (1) to create a more-informed, better-educated cadre of township officials who are more confident and competent in carrying out their roles and responsibilities as leaders in their communities; and (2) to generate greater effectiveness on the part of local government. Below are the core competencies for the Supervisor. Please visit the Clerk, Treasurer, and Board of Trustees pages to see the core competencies for those positions.

Township Government Operations

~Demonstrates knowledge about township (general law or charter) government responsibilities, functions and powers

~Identifies the major functions of each branch of government—local, state and federal—along with their relationship to one another

-Understands the statutory duties and responsibilities of the office of township supervisor

~Aware of the roles and responsibilities of other elected and appointed offices in the township

~Demonstrates knowledge of the various committees, boards and commissions serving the township, including their roles and responsibilities

~Understands how township policies and procedures are set

~Demonstrates knowledge of how ordinances are lawfully adopted and legally enforced

Interpersonal Skills

~Communicates effectively

~Listens attentively

~Works effectively with individuals, departments, and committees to achieve desired outcomes

~Possesses knowledge of what constitutes ethical behavior

~Manages adversity and hostility effectively

Leadership Abilities

~Possesses vision, especially relative to the township’s needs or potential

~Leads effective board meetings and is knowledgeable about parliamentary procedure

~Possesses effective policy-making skills and decision-making skills

~Utilizes consensus-building techniques

~Possesses persuasive/influential abilities

~Motivates others to achieve desired outcomes

~Utilizes public relations skills to position the township positively

Management Skills

~Makes decisions consistent with desired outcomes

~Utilizes strategic planning to attain objectives

~Develops and oversees the budget

~Understands purchasing policies and the bid process

~Possesses knowledge of personnel administration

~Understands the collective bargaining process, including legal framework (only applicable to some townships)

~Negotiates issues and contracts effectively

Township Issues

~Possesses knowledge about current issues affecting townships

~Aware of legal matters that could impact the township

~Understands the elements of risk management

~Aware of financial matters affecting the township, including revenue sources

~Possesses knowledge about land use

~Understands the planning and zoning process

~Possesses knowledge of township services and their policy implications

CLERK’S OFFICE

Robert D. Buechler

Clerk

Email: rbuechler@fortgratiot.us

(810) 385-4489, ext. 1104

Office of the Clerk

Vicki Ostrander – Deputy Clerk

Email: vostrander@fortgratiot.us

Phone: (810) 385-4489 x1103

Nancy Decoursey – Accountant

Email: ndecoursey@fortgratiot.us

Phone: (810) 385-4489 x1102

Election Dates and Voting Precinct Map: Voting Precincts 2012

Core Competencies: The Building Blocks of Township Government

To ensure that all township officials have the opportunity to learn what they need to know to carry out their statutory duties as well as understand effective township management practices, the Michigan Townships Association has identified “core competencies.” Essentially, they are the “nuts and bolts” that each of the four elected offices at the township level should know and/or be skilled in to successfully perform their duties.

The list should not be construed as all-inclusive; rather they should be considered an overview of the knowledge and skill sets that an individual should possess. Note that each checklist is dynamic in the sense that it will change over time, adapting to legislation, legal issues, and other factors that impact township government and the responsibilities of the elected official.

The core competencies address two goals: (1) to create a more-informed, better-educated cadre of township officials who are more confident and competent in carrying out their roles and responsibilities as leaders in their communities; and (2) to generate greater effectiveness on the part of local government. Below are the core competencies for the Clerk. Please visit the Supervisor, Treasurer, and Board of Trustees pages to see the core competencies for those positions.

Township Government Operations

~Demonstrates knowledge about township (general law or charter) government responsibilities, functions and powers

~Identifies the major functions of each branch of government—local, state and federal—along with their relationship to one another

~Understands the statutory duties and responsibilities of the office of township clerk

~Aware of the roles and responsibilities of other elected and appointed offices in the township

~Demonstrates knowledge of the various committees, boards and commissions serving the township, including their roles and responsibilities

~Understands how township policies and procedures are set

~Demonstrates knowledge of how ordinances are lawfully adopted and legally enforced

Interpersonal Skills

~Communicates effectively

~Listens attentively

~Works effectively with individuals, departments and committees to achieve desired outcomes

~Possesses knowledge of what constitutes ethical behavior

~Manages adversity and hostility effectively

~Delegates tasks appropriately

Leadership Abilities

~Possesses vision, especially relative to the township’s needs or potential

~Understands how to conduct effective board meetings and is knowledgeable about parliamentary procedure

~Possesses effective policy-making skills and decision-making skills

~Utilizes consensus-building techniques

~Possesses persuasive/influential abilities

~Motivates others to achieve desired outcomes

~Utilizes public relations skills to position the township positively

Administrative Skills

~Possesses knowledge of the communication/noticing needs of the township and devises strategies to assemble and disseminate information to relevant audiences

~Understands the township budget and the clerk’s role in monitoring budget

~Aware of purchasing policies and the bid process

~Demonstrates knowledge of uniform chart of accounts and township accounting practices

~Possesses understanding of personnel administration and human resources matters

~Has ability to transcribe minutes of the proceedings of each township board meeting in an accurate and proper manner

~Understands maintenance of township records, books and papers in accordance with record retention and disposal guidelines

~Possesses knowledge of elections and clerk’s role in overseeing the elections process

Township Issues

~Possesses knowledge about current issues affecting townships

~Aware of legal matters that could impact the township

~Understands the elements of risk management

~Aware of financial matters affecting the township, including revenue sources

~Possesses knowledge about land use

~Understands the planning and zoning process

~Possesses knowledge of township services and their policy implications

TREASURER’S OFFICE

Calls for tax amounts, special assessments and water & sewer account questions may be directed to the treasurers office at (810) 385-4489 x1118

George F. Wells

Treasurer

Email: treasurer@fortgratiot.us

Phone: (810) 385-4489, ext. 1114

Under MCL 211.44(2), on the last day of February each year, the Treasurer’s Office will be open between 9:00 a.m. and 5:00 p.m. If the last day of February falls on a weekend, extended office hours will then be held the following Monday. This statute also provides the Treasurer’s Office remain open for one day from 9:00 a.m. until 5:00 p.m. sometime between December 25th and January 1st. Generally, the Treasurer’s Office extends office hours this day on the last business day the Township is open during the chosen week.

Township Funds:

The Treasurer’s Office is responsible for the collection of Taxes, Water Bills, Permit Fees, and any other fees or payments owed. The Treasurer’s Office is also responsible for depositing, investing, and transferring funds to cover payments, as well as balancing bank statements. The Treasurer also assists in generating yearly budgets, and twice a month provides a complete financial report on all Township funds to the Board of Trustees.

Payment Options:

Payments may be made in person, by mail, or by being placed in the after-hours drop box by check or cash. Credit card payments can be made in person or online, but cannot be accepted over the phone. All payments placed in the drop box on the due date are considered on time. Payments sent via mail are considered on time if postmarked on or before the due date. To pay online, follow the links below. For the utility bill, select the “Search by Address” option, leave the street name blank and enter your street number in both “Street Number” boxes and click “Search.” This will bring up all Fort Gratiot properties with that street number. Select yours and follow the prompts. For tax bills, you can use any of the search options available on the screen. There are several screens to verify your information before you are charged, including the screen showing the credit card fee. For all credit card transactions the fee is 3% of the transaction, with a minimum fee of $2.00. The fees go directly to the credit card company. You will receive a confirmation email from support@pointandpay.com with a confirmation number and the transaction details. Click here to pay your utility bill online. Click here to pay your tax bill online.

or by phone: 833-819-5112 fees do apply

Automatic (ACH) Withdrawal payments are also offered. These payments will automatically be deducted from your checking/savings account on the due date each billing period. To enroll, please complete the forms below and submit to the Treasurer’s office. Please note that the auto payments continue until written notice of cancellation is received.

Designated Agent Forms:

If an individual other than the homeowner, such as a mortgage company, is responsible for paying taxes, a Designated Agent form must be filled out and kept on file with the Treasurer’s Office, as required by MCL 211.44(9)(a) passed in April, 1999.

Deferment of July Property Taxes:

If certain criteria are met, July tax on principal residences may be deferred until February 14th without penalty, under MCL 211.51. Applications for this deferment must be filed with the Township Treasurer’s Office no later than September 15th. Gross household income must be under $35,000, and applicants must be at least 62 years of age, an eligible serviceperson or veteran, or disabled as set forth in the law.

July Property Tax Bills:

July tax bills are mailed July 1st, and are due by September 14th at 5pm without penalty. Partial payments are accepted on all taxes. A 2% penalty is added to any unpaid balance on September 15th, with another 1% being added the first of each month thereafter, until the books are closed on March 1st. The July tax bill consists of Port Huron Area School District, St. Clair County RESA (formerly ISD), State Educational Tax, and St. Clair County Operating Tax. The Treasurer’s Office then distributes the taxes collected to the School District, RESA, State and County.

December Property Tax Bills:

December tax bills are mailed December 1st, and are due by February 14th at 5pm without penalty. Effective February 15th, a 3% penalty is assessed on any unpaid balance. February 28th is the last day to pay Summer or Winter taxes. The December bill includes taxes for the Blue Water Area Transportation Commission; County Operations; including the St. Clair County Drug Task Force, St. Clair County Senior Citizens, County Parks, County Library, and Community College; as well as Fort Gratiot Township Operations; including Township Fire, Police, and Special Assessments. As with the July tax bills, the Treasurer’s Office distributes the collected funds to all individual entities.

Garage Sale Permits:

Under Township Ordinance #89, each household is allowed 3 garage sales in any 12 month period. Each sale can span 4 consecutive days. Garage Sale permit fees are $2.00, and all permits must be displayed for the duration of the sale.

2017 PROPERTY TAX PREPAYMENT INFORMATION

Taxes cannot be prepaid for 2018 in Michigan because the 2018 taxes have not been assessed yet.

In areas of Michigan and in other states where municipalities are accepting prepayment, the IRS has not confirmed that it will accept the prepayment.

The IRS has received a number of questions from the tax community concerning the deductibility of prepaid real property taxes. In general, whether a taxpayer is allowed a deduction for the prepayment of state or local real property taxes in 2017 depends on whether the taxpayer makes the payment in 2017 and the real property taxes are assessed prior to 2018.

A prepayment of anticipated real property taxes that have not been assessed prior to 2018 are not deductible in 2017. State or local law determines whether and when a property tax is assessed, which is generally when the taxpayer becomes liable for the property tax imposed.

The General Property Tax Act in Michigan (MCL 211.1-211.157) does not allow for local governments to accept prepayment of taxes. We can only do that which we are permitted to do by state law. Such provision simply does not exist.

At present there is no property tax levied for 2018. That will not occur until the assessors make their assessments, send out assessment notices in February 2018, allow for property owners to protest their assessments at the Board of Review in March 2018, allow for the county equalization department to complete their process in April 2018, and allow for the various taxing jurisdictions to levy their millage in conjunction with the adoption of their budgets which in some cases takes place in May and early June 2018. Therefore, the property tax does not become a tax owing until July 1, 2018.

Therefore, since there exists no property tax yet for 2018, the taxpayer does not have a tax that can be itemized on their 2017 federal income tax form.

Core Competencies: The Building Blocks of Township Government

To ensure that all township officials have the opportunity to learn what they need to know to carry out their statutory duties as well as understand effective township management practices, the Michigan Townships Association has identified “core competencies.” Essentially, they are the “nuts and bolts” that each of the four elected offices at the township level should know and/or be skilled in to successfully perform their duties.

The list should not be construed as all-inclusive; rather they should be considered an overview of the knowledge and skill sets that an individual should possess. Note that each checklist is dynamic in the sense that it will change over time, adapting to legislation, legal issues, and other factors that impact township government and the responsibilities of the elected official.

The core competencies address two goals: (1) to create a more-informed, better-educated cadre of township officials who are more confident and competent in carrying out their roles and responsibilities as leaders in their communities; and (2) to generate greater effectiveness on the part of local government. Below are the core competencies for the Treasurer. Please visit the Supervisor, Clerk, and Board of Trustees pages to see the core competencies for those positions.

Township Government Operations

~Demonstrates knowledge about township (general law or charter) government responsibilities, functions and powers

~Identifies the major functions of each branch of government—local, state and federal—along with their relationship to one another

~Understands the statutory duties and responsibilities of the office of township treasurer

~Aware of the roles and responsibilities of other elected and appointed offices in the township

~Demonstrates knowledge of the various committees, boards and commissions serving the township, including their roles and responsibilities

~Understands how township policies and procedures are set

~Demonstrates knowledge of how ordinances are lawfully adopted and legally enforced

Interpersonal Skills

~Communicates effectively

~Listens attentively

~Works effectively with individuals, departments, and committees to achieve desired outcomes

~Establishes appropriate contacts with banks, mortgage companies, insurance and investment firms

~Possesses knowledge of what constitutes ethical behavior

~Manages adversity and hostility effectively

~Delegates tasks appropriately

Leadership Abilities

~Possesses vision, especially relative to the township’s needs or potential

~Understands how to conduct effective board meetings and is knowledgeable about parliamentary procedure

~Possesses effective policy-making skills and decision-making skills

~Utilizes consensus-building techniques

~Possesses persuasive/influential abilities

~Motivates others to achieve desired outcomes

~Utilizes public relations skills to position the township positively

Administrative Skills

~Demonstrates knowledge of uniform chart of accounts, generally accepted accounting practices and proper internal controls

~Implements sound cash management procedures and proper handling of funds, including knowledge of investment instruments and legal limitations on investments