PARKS COMMISSION

Please see the Parks tab on home page for more information

ASSESSOR’S OFFICE

Stephen Jones, Assessor

Phone: (810) 385-4489 x1101

Email: [email protected]

Autumn Westbrook, Assistant Assessor

Phone: (810) 385-4489 x1106

Email: [email protected]

Molly Perry, Assessing Clerk

Phone: (810) 385-4489 x1199

Email: [email protected]

–

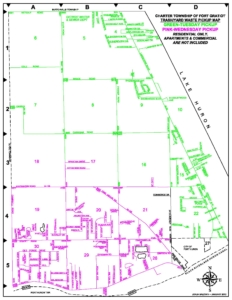

The Assessing Department is responsible for assessing all Real and Personal Property located within Fort Gratiot Township in accordance with Michigan’s General Property Tax Laws and the State Tax Commission (STC) guidelines. The task of assessing requires the maintenance of records on each parcel of property.

Assessments are reviewed each year. Assessment Change Notices are mailed at the end of February. Board of Review meets to hear aggrieved taxpayers the Monday following the first Tuesday in March. Time and dates of these meetings are written on the change notices.

Click HERE to see the 2025 Board of Review schedule.

Bulletin-17-of-2024—Procedural-Changes-for-2025

–

UNDERSTANDING PROPOSAL A AND YOUR PROPERTY ASSESSMENT

On March 15, 1994, Michigan voters approved the Constitutional Amendment, known as Proposal A, which limited the amount that property taxes could increase on an annual basis. Prior to Proposal A, property taxes were based upon Assessed Value (AV). Since the passing of Proposal A, property taxes are now based upon Taxable Value (TV). Taxable Value increases are limited to the Inflation Rate Multiplier (IRM), also referred to as the Consumer Price Index (CPI), or five percent (5%) whichever is lower, not to exceed Assessed Value until ownership of the property is transferred. The year following the transfer, the Assessed Value and Taxable Value will be the same. This is referred to as an uncapping. Proposal A has limited the property taxes that would have been collected if Proposal A had not been implemented, which has saved the average homeowner in Fort Gratiot Township thousands of dollars each year, since 1994.

Assessed Value represents approximately 50% of the estimated Market Value (or True Cash Value). Your Assessed Value is not based on 50% of your individual sales price. The law defines Market Value as the usual selling price of the property. The Michigan Legislature and courts have clearly stated that the actual sales price of a property is not the only controlling factor in determining the True Cash Value and Assessed Value.

–

Types of ECF (Economic Condition Factor) Studies:

2025 Agricultural Commercial Industrial ECF

Types of Land Studies:

2025 Agricultural Commercial Industrial

Sales Study:

For more information, check out the link below!

Property Tax and Assessment Information

–

2025 Policies & Resolutions:

2025 Poverty Exemption Guidelines Resolution

2025 PP Annual Canvass Policy & Annual PP Roll Maintenance

2025 Property Tax Admin Fee For Assessing Property Values & Collecting Tax Levies Resolution

2025 Notice of Proposed Guideline

2025 Exemption from Property Taxes Application & Approval Policy

–

REAL PROPERTY FORMS & INFORMATION

- Property Transfer Affidavits: (Download the Application) Property Transfer Affidavits must to be received by this office within 45 days of property transfer.

- PRE-Principal Residence Exemption (Homestead) Affidavits: (Download the Affidavit) PRE Affidavits are required for Exemption of the 18 Mill School Tax that is part of the tax bill. Filing Deadline is June 1st of the calendar year. The property listed MUST BE THE PRIMARY RESIDENCE, OWNED and OCCUPIED by the individual(s) requesting the exemption.

- Poverty Exemptions Resolution, Guidelines & Application: Are you dealing with economic hardship?

CLICK FOR 2025 POVERTY EXEMPTION PACKET

- Disabled Veterans Property Tax Exemption: Are you an honorably discharged veteran with a service-related disability?

CLICK FOR ELIGIBILITY REQUIREMENTS, FORMS, & ADDITIONAL INFORM ATION

(redirects to STC website to locate Bulletin 19 of 2023, Form 5107, 6054, 6055, etc.)

- Personal Property Tax Exemptions: Are you a small business owner? Is your True Cash Value of personal property between $80,000 and $180,000?

CLICK FOR FILLABLE FORM 5076 & QUALIFICATIONS

**Sold, closed, or moved business(es) must notify the assessor immediately to avoid the possibility of being estimated for tax purposes.**

Not eligible for the exemption? Please mail, deliver or email a Personal Property Statement (L- 4175) by the deadline of February 20th.

For more information on other property tax exemptions and other forms, click HERE.

BOARD OF REVIEW

*SEEKING ONE OR TWO ALTERNATE BOARD OF REVIEW MEMBERS*

The Board of Review meets approximately seven (7) times per year. The dates for 2025 are below. All meetings are held at the Fort Gratiot Municipal Center beginning at 9:00 AM and may go as late at 5:00 PM. Training opportunities are available and attendance is strongly encouraged for members throughout the year. (Starting in 2021 some training will be mandatory, AT LEAST ONCE PER TERM.) Cost, meals, and mileage are paid in advance and/or reimbursed.

The term is January 1, 2025 through January 1, 2026. Members are compensated $500 for March, $50 for July and $50 for December.

Any person interested in being considered for an appointment to the Board of Review must submit a letter/email of interest to the Fort Gratiot Charter Township Board of Trustees. Emails may be sent to [email protected] or letters can be mailed or dropped off at the FGMC, 3720 Keewahdin Road, Fort Gratiot, Michigan 48059. Letters/emails of interest must be received no later than Friday, February 24, 2025 at 4:00 PM to be considered. The appointments will be made no later than the Wednesday March 5, 2025 Board of Trustees meeting.

The Fort Gratiot Township Board of Review is made up of four or five people: three members and one or two alternates. The members are Bonnie Barrett, Dean Marlar, Jodi Smith and Patti Bundy (alternate). Below are the dates the BOR will meet in 2025, the answers to some frequently asked questions and some forms that may be necessary to be filed or taken to the BOR’s.

2025 BOARD OF REVIEW MEETING DATES (click for more info)

Tuesday, March 4, 2025, 9:00 AM

Organizational – No appeals heard

Monday, March 10, 9:00 AM – 12 PM & 1 PM – 4 PM

BY APPOINTMENT Appeals Only – No Corrections

Thursday, March 13, 6 PM – 9 PM

BY APPOINTMENT Appeals Only – No Corrections

Friday, March 14, 9 AM – 12 PM

BY APPOINTMENT Appeals Only – No Corrections

Letter appeals are due by 12:00 PM on Thursday, March 13, to be considered

Decision and Corrections will be made the following week; week of March 17 to March 21, 2025. A special meeting notice will be posted at least 18 hours before said meetings.

Tuesday, July 22, 9:00 AM

Clerical errors and mutual mistakes of fact, PRE’s for Current year and possibly up to 3 years prior, Disabled Veteran Exemptions for current year only, Poverty Exemptions for current year only – No Assessment Appeals will be heard.

Tuesday, December 9, 9:00 AM

Clerical errors and mutual mistakes of fact, PRE’s for Current year and possibly up to 3 years prior, Disabled Veteran Exemptions for current year only, Poverty Exemptions for current year only – No Assessment Appeals will be heard.

2025 Board of Review (BOR) and Key Topics Course List

-

- 2025 Assessing District Required BOR Training Report

- STC BOR Q&A

- Form 5511, Application to Request Board of Review Member Training Program Material

- Audit of Minimum Assessing Requirements

- General Property Tax Act (PA 206 of 1893)

- Supervising Preparation of the Assessment Roll

- Bulletin-15-of-2024—2025-Boards-of-Review

- Guide to Basic Assessing

- Property Classification Q & A

- Disabled Veterans Exemption FAQs

- Essential Services Assessment FAQ

- Qualified Agricultural Property Exemption Guidelines

If you have questions regarding your Notice of Assessment or to schedule an appointment with the BOR, you may contact our assessing department during regular business hours.

Click here to view assessing records. On the left of the AccessMyGov Fort Gratiot page, click Assessing Search. A bar near the top of the page will appear. Enter the address of the property you are searching for and click SEARCH on the right. On the next screen click the property address and you will be taken to the Record Details page.

F.A.Q.’S

Can a Board of Review set the SEV or Assessed Value at the sales price of the property? No. This practice is illegal in Michigan. An individual sale price IS NOT the same as True Cash Value of the Property due to a variety of reasons, including among those an uninformed buyer, an uninformed seller, insufficient marketing time, buyer and seller are relatives, and other reasons.

Section 27(5) of the General Property Tax Act states the following: “Beginning December 31, 1994, the purchase price paid in a transfer of property is not the presumptive True Cash Value of the property transferred. In determining the True Cash Value of transferred property, an assessing officer shall assess that property using the same valuation method used to value all other property of the same classification in the assessing jurisdiction.”

Therefore, a Board of Review does NOT have the authority to change an assessment based on a sale price.

Is this what the State Tax Commission means when it says a Board of Review or Assessor cannot “follow sales”? Yes. “Following sales” is defined in the assessor’s manual as the practice of ignoring the assessment of properties, which have not recently been sold, while making significant changes to the assessments of properties which have been sold. The practice of “following sales” is a serious violation of the law. The practice of following sales results in assessments that are not uniform.

What is Proposal A? On March 15, 1994 the voters of the State of Michigan approved Proposal A. Prior to Proposal A, property taxes were based on STATE EQUALIZED VALUE. Proposal A established TAXABLE VALUE as the basis for calculation of property taxes.

What is Assessed Value and is it still important? Michigan law requires that all property be uniformly assessed at 50% of the usual selling price, or sometimes called the True Cash Value. Each year, assessors must still prepare an assessment roll that contains “traditional” Assessed Valuations at 50% of True Cash Value.

What is Taxable Value? Except when there is a transfer of ownership in the prior year, Taxable Value for a parcel of property is the LOWER of STATE EQUALIZED VALUE for the parcel, or the CAPPED VALUE for the parcel.

What is State Equalized Value? State Equalized Value or SEV is the Assessed Value, as adjusted following State and County Equalization.

What is Capped Value? Capped Value is calculated by adjusting the prior year Taxable Value of the property by any additions or losses and multiplying by the inflation rate multiplier (IRM). The IRM is calculated based on statute and cannot be greater than 1.05 (1 + 5%).

The Capped Value formula is: (Prior Year Taxable Value – Losses) x (IRM) + Additions.

What is the Inflation Rate Multiplier and how is it calculated?

INFLATION RATE is defined in the Statute as the ratio of the general price level for the state fiscal year ending in the calendar year immediately proceeding the current year divided by the general price level for the state fiscal year ending in the calendar year before the year immediately proceeding the current year.

The Statute also defines GENERAL PRICE as the annual average of the 12 monthly values for the United States consumer price index for all urban consumers as defined and officially reported by the United States Department of Labor, Bureau of Labor Statistics.

Based on this statutory requirement, a sample calculation for 2013 is as follows:

A. The 12 monthly values for October 2011 through September 2012 are averaged.

B. The 12 monthly values for October 2012 through September 2013 are averaged.

The ratio of B divided by A is calculated and this becomes the IRM.

The Inflation Rate Multiplier (CPI) for 2014 is 1.6%. This means that the taxable value for your property will increase by 1.6%. Physical changes in your property may also increase or decrease your Taxable Value. Changes in the State Equalized Value due to Market Value changes may also affect the Taxable Value, since the Taxable Value cannot be higher than the State Equalized Value.

Does the Board have any authority over Capped Values? STC Bulletin No. 14 of 1994 states: an assessment roll must contain the Capped Value for each parcel of real property.

If correct figures have been used in the Capped Value formula for the prior year Taxable Value and for the current Inflation Rate Multiplier, the Board of Review cannot make a change that results in a different capped value of the property.

The Board of Review may change the amount of the Losses and Additions used in the Capped Value formula, if they determine they are improper. Only factual information will be used to amend the Losses or Additions in the Capped Value formula.

STC Bulletins 3 of 1995, 18 of 1995, and 3 of 1997, address the procedures required by law for determining the amount of Losses and Additions for calculation of the cap on Taxable Value. (Note: an increase in value due to an increase in a property’s occupancy rate is not a legal addition in the Capped Value formula.)

What is Uncapping? When a property transfers ownership as defined by law, the property’s Taxable Value uncaps the following year. A property on which “Transfer of Ownership” occurred shall have its Taxable Value uncapped the following year. For example, a property that transferred in 2013 will have the 2014 Taxable Value equal to its 2014 SEV. A Question and Answer document regarding many common Transfer of Ownership questions is available at www.michigan.gov/treasury.

Does the Property then “recap”? The growth in Taxable Value of transferred properties will then be capped again in the second year following the “Transfer of Ownership”

What are the authorities of the Board of Review over transfers of ownership and uncapping? The assessor of each Township and City is required by law to review all of the transfers and conveyances, which occurred in the prior year and determine which of these transfers and conveyances, are “Transfers of Ownership”.

The determination by the assessor that a particular transfer or conveyance is a “Transfer of Ownership” and that the property’s Taxable Value should be uncapped is subject to review by the March Board of Review either on the Board’s own initiative or at the request of a property owner.

Public Act (PA) 23 of 2005 granted the July or December Board of Review the authority to correct the Taxable Value of property which was previously uncapped (due to a perceived transfer of ownership) if the assessor later determines there had NOT been a transfer of ownership of that property after all. This authority applies to the current year and the 3 immediately preceding years. Bulletin 9 of 2005 provides more detailed information.

State Tax Commission Bulletin No. 19 of 1997

DATE: December 12, 1997

TO: Assessing Officers, Equalization Directors

FROM: State Tax Commission (STC)

RE: THE ILLEGAL PRACTICES OF: A) “FOLLOWING SALES”

The State Tax Commission is very concerned about reports that some assessors have engaged in the illegal practices of “following sales” and assessing over 50% of true cash value.

The purpose of this bulletin is to provide instruction to assessors regarding these illegal practices.

- A. “Following Sales”

“Following sales” is described in the State Tax Commission Assessor’s Manual as the practice of ignoring the assessments of properties which HAVE NOT RECENTLY SOLD while making significant changes to the assessments of properties which HAVE RECENTLY SOLD.

“Following sales” can also be described as the practice of assessing properties which HAVE RECENTLY SOLD significantly differently from properties which HAVE NOT RECENTLY SOLD.

Article IX, Section 3 of the State Constitution states that “The legislature shall provide for the UNIFORM general ad valorem taxation of real and tangible personal property …” This requirement has NOT changed as a result of Proposal A.

Section 27(5) of the General Property Tax Act states the following:

“In determining the true cash value of transferred property, an assessing officer shall assess that property using the same valuation method used to value all other property of that same classification in the assessing jurisdiction.”

The following example illustrates the illegal practice of “following sales”.

EXAMPLE: An assessor has been notified by the equalization department that the starting base for the residential class in his/her unit is 45.45%. This means that it is necessary for the assessor to increase the residential class overall by about 10% in order to avoid a factor. It is the assessor’s responsibility to determine where this increase should be spread in order that all properties are assessed at 50%.

It would be illegal for the assessor to generally increase properties which have recently sold by say 25% while increasing all other properties in a neighborhood by say 5%. This would be an example of the illegal practice of “following sales”.

“Following sales” is both UNCONSTITUTIONAL AND ILLEGAL. An exception would occur where an assessor inspects a property after a transfer of ownership and discovers that there is omitted property such as a garage which was built in the past but was not included in the assessment and was not noted on the assessment card. In this case the assessor must include the omitted property in the assessed value for the year following the transfer of ownership.

If the assessor is doing a proper job of assessing all properties uniformly at 50% of true cash value each year, there is no reason to assess properties which have sold any differently from properties which have not sold.

In a related matter, some assessors believe that Proposal A requires that, in the year following a transfer of ownership, the assessed value of a property which has transferred must automatically be set at 1/2 of the sale price. Proposal A does NOT authorize the assessor to AUTOMATICALLY set the assessed value of a property which has sold at 1/2 of the sale price. An individual sale price may NOT be a good indicator of the true cash value of the property due to a variety of reasons (such as an uninformed buyer, an uninformed seller, insufficient marketing time, buyer and seller are relatives, and other possible reasons).

BUILDING DEPARTMENT

Fort Gratiot, Michigan 48059

Office: (810) 385-4489, ext.1112

Facsimile: (810) 385-9010

Email: [email protected]

Office Hours: Monday – Friday, 8:00 am – 4:30 pm (lunch 12:30ish-1:30ish)

| It is the goal of Fort Gratiot Township Building Department to make the process of obtaining permits user friendly. To achieve this goal, we need full cooperation from both contractors and homeowners so we can better work together. For your convenience, we’ve listed some of the guidelines below which outline the process: |

| DOCUMENTS TO BE PROVIDED BY CONTRACTOR |

DOCUMENTS TO BE PROVIDED BY APPLICANT (HOMEOWNER/CONTRACTOR) |

| 1. Picture I.D. | 1. Residential: Two (2) complete sets of prints; Commercial: Three (3) complete sets of prints. Building Dept will retain one full set of prints and will return the additional sets to the applicant upon permit issuance. |

| 2. Proof of license | 2. Driveway/Culvert Permit obtained from the SCC Road Commission (if applicable) |

| 3. Proof of Liability Insurance | 3. EGLE High Risk Erosion Permit and/or Wetland Assessment (if applicable) |

| 4. Federal I.D. Number | 4. Address Application (if applicable) |

| 5. Health Department approval for well/septic and/or Soil Erosion and Sedimentation Control (if applicable) | |

| 6. Site Plan approval (if required by Planning Commission – see Zoning Administrator) | |

| 7. FEMA Flood Zone construction (if applicable): Letter of Map Amendment (LOMA) or professional elevation survey reflecting that the construction location is above flood zone levels. If the proposed work is below the minimum flood zone level, prints must reflect that the construction will meet flood zones standards. | |

| 8. Professional survey reflecting existing structures, proposed construction, setbacks, etc., as required. | |

After the permit is issued, inspections will need to be conducted by our inspectors at the request of the permit holder. Please contact Courtney at (810) 385-4489, ext. 1112 to schedule all inspections. Please call 24 hours in advance as our inspectors are part-time. They each attend continuing education classes throughout the year and may not be available.

|

| BASIC STEPS OF BUILDING PERMIT APPLICATION PROCEDURE: |

| 1. Applicant fills out application in full for submittal. |

| 2. Applicant submits all paperwork required for approval (see above items) |

| 3. Residential: Two (2) full sets of plans with all structural information completed. |

| 4. Commercial: Three (3) full sets of plans with all structural information completed. If the job is in Birchwood Mall located at 4350 24th Ave, the plans must be signed and sealed with stamped approval of the mall. Unit number must be reflected on the permit application. |

| 5. Applicant allows 10-21 business days for plan review to be completed by the inspectors and 7-15 business days for permit application approval. |

| 6. The applicant will be notified of the plan review results and when the permit is ready for payment and issuance. |

| INSPECTIONS (MUST PHONE 24 HOURS IN ADVANCE) | |

| ELECTRICAL INSPECTIONS | BUILDING INSPECTIONS |

| 1. Service | 1. Ground Water Investigation (at time of excavation) |

| 2. Rough Electrical | 2. Footing (Before the pour of concrete) |

| 3. Final | 3. Foundation/Basement |

| 4. Backfill | |

| 5. Floor Joist/Decking | |

| 6. Rough Framing | |

| 7. Insulation | |

| 8. Drywall nail pattern before tape & mud (Commercial only) | |

| 9. Temporary or Final Occupancy | |

|

*NOTE: ADDRESSING MUST BE DISPLAYED ON PROPERTY BEFORE FINAL CERTIFICATE OF OCCUPANCY IS ISSUED. |

|

| For certain types of construction, not all inspections above will apply. In order to keep construction progressing, it is very important that all required inspections are conducted. Inspection histories are computerized so if you need to know when an inspection was performed, the information can be obtained by a quick phone call to the Building Department.

Setting up an inspection is quick and easy: 1. Call the Building Department (810) 385-4489, ext. 1112. 2. Give the property address, permit number and the best time frame the inspector can access the jobsite. We realize that it is sometimes difficult to predict when you will be ready for an inspection, but please call 24 hours in advance as our inspectors are part-time. |

|

Temporary Occupancy “To Stock Only” This certificate is usually only issued if there is work that is incomplete to the point where the site would be unsafe to occupy, but is finished enough to move belongings in. For example, a moving company delivering furniture or a commercial store stocking shelves. Final Certificate of Occupancy “Final C of O” The Final Certificate of Occupancy is issued by the building inspector. Before the building inspector is contacted, you must have final approval from the electrical, mechanical and plumbing inspectors. The last step will be to call the Building Department to request Final Occupancy, which will allow you to move into your new home or business. If Fire Department inspections are required for occupancy, the Building Department will schedule them accordingly. |

Current Codes pursuant to Ordinance 206, effective July 12, 2011

PLANNING & COMMUNITY DEVELOPMENT

Portside Solar

- MPSC Draft Act 233 Solar Energy, Wind Energy, and Energy Storage Facilities Application-1

- Outline for Portside Solar Settlement Proposal

- Outline – Public Act 233 of 2023

- Outline – Act 233 -v- Settlement Proposal

- Portside Solar Status 11-14-2023

- Portside Solar Judgement 12/04/2024

LINKS AND INFORMATION

Click here for the current Zoning Map

Click here for the Fort Gratiot Master Plan 2020-2025

Click here for the current Fort Gratiot Street Map

Code of Ordinances: http://library.municode.com/index.aspx?clientId=13743

Following are ordinances that have been added or updated and are effective, but are not online yet:

Click here for Permitted Exterior Materials (Ordinance No. 184)

Click here for Planned Shopping Center Regulations (Ordinance No. 185)

Click here for Signs (Ordinance No. 207)

Click here for the C-2 General Business District Regulations (Ordinance No. 211)

Click here for the Solar Energy Systems Ordinance

St. Clair County Drain Commissioner Rules – Effective 10/01/2018

Click here to view the 2018 MSU Study of Birchwood Mall

Click here to view the 20185 MSU Birchwood Mall Study Presentation

PLANNING COMMISSION

The Planning Commission meets on the second Tuesday of each month in the Fort Gratiot Municipal Center Gardendale Meeting Room, beginning at 7 PM. The Planning Commission must meet a minimum of four times per year, so please contact this office or visit the website for the agenda. If there are no proposals for the PC to review, a meeting may be cancelled.

The links below, courtesy Michigan State University Extension (2023,) are informational flyers designed to help any member of the public, a neighborhood association, or citizen group better understand the process and participate at Planning Commission and Zoning Board of Appeals public hearings.

Citizen Participation Guide for Zoning Amendments – Planning Commission

Citizen Participation Guide for Special Land Use Requests – Planning Commission

Citizen Participation Guide for ZBA Appeals and Variances – Zoning Board of Appeals

DEPARTMENT OF PUBLIC WORKS

Department of Public Works

Greg Randall, DPW Superintendent

Office: (810) 385-4489 ~ Facsimile: (810) 385-9010

After Hours Emergency: 810-650-0208 or 810-650-3119

WATER/SEWER RATES

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

There a few pieces of information required to calculate the cost, whether you are calling us or estimating on your own:

- The gallons of water your pool holds

- If you have water only (with a septic field) or water and sewer

- Our current water and sewer rates

On the home page, under Quick Links on the left, there is a link for Utility Billing Search & Pay (or click here) where you can enter your account name or address to view the current bill and a history of prior bills. This may help to compare the current quarter to see what you have previously paid for the same time period and whether you are a water and sewer customer or if you are a water only customer.

Now that you have the info, above, you are ready to call us or estimate on your own.

To estimate on your own, first convert the number of gallons your pool holds into cubic feet. To do this, multiply the number of gallons by 0.1337 to obtain cubic feet (c.f.).

- Example: 25,000 gallons x .1337 = 3,342.50 cubic feet.

Next, take your calculated cubic feet and divide by 1000 to get the MCF (per 1000 c.f.)

- Example: 3,342.50 c.f. divided by 1,000 = 3.34250 MCF

Now multiply that figure by the current applicable rate(s).

- Example-Water customer only: 3.34250 x $44.50 (current water rate) = $148.74 for the water cost

- Example-Water & sewer customer: 3.34250 x $44.50 (current sewer rate) = $148.74 plus the $148.74 for water = $297.48

Generally the costs for filling your pool through your tap can be less expensive than a delivery service, but it can take hours to accomplish. If you choose to fill your pool on your own, you may have decreased water pressure while your hose or hoses are filling. Our Fire Department and DPW do not fill pools with our tankers; and in no instance should anyone turn on a fire hydrant for personal use.

ELECTIONS

2024 ELECTIONS

Presidential Primary – Tuesday, February 27, 2024

Special Election – Tuesday, May 7, 2024

Primary Election – Tuesday, August 6, 2024

General Election – Tuesday, November 5, 2024

Polls are open from 7:00 AM until 8:00 PM on each election day.

With the passage of Proposal 22-2, for statewide and federal elections, in-person early voting is available nine consecutive days beginning on the second Saturday prior to the election and ending the Sunday prior to the election. Dates and times for early voting will be posted here. More detailed information is below.

For more information from the State of Michigan, click here to be redirected to the Secretary of State Voter Information Center

For more information from the St. Clair County Clerk, click here to be redirected to the St. Clair County Clerk’s Office Elections website.

Elections administration is handled by the elected Clerk and appointed Deputy Clerk, as required by state statute. The Clerk’s office is located in the Fort Gratiot Municipal Center, 3720 Keewahdin Road, Fort Gratiot, Michigan 48059. The Clerk’s office is open Monday through Friday, 8:00 AM – 4:30 PM. Generally, break periods are staggered and someone is in the office. However, if you need to speak with someone in person, we recommend contacting the office to make an appointment.

Clerk Robert D. Buechler[email protected](810) 385-4489 x 1104 |

Deputy Clerk Vicki Ostrander[email protected](810) 385-4489 x 1103 |

REGISTER TO VOTE

Voters can check their voter registration status here: Michigan Secretary of State Voter Registration Lookup

Michigan voters are encouraged to register as early as possible before an election. Methods and requirements for voter registration depend on the following deadlines:

- 15+ days before an election: voters can register online, by mail, or in person.

- 14 days or less prior to an election, and on Election Day: voters may only register by visiting their local clerk’s office to register in person with proof of residency documentation.

IN PERSON-CLERK’S OFFICE. Fort Gratiot residents may register in-person during regular business hours at the Fort Gratiot Municipal Office, 3720 Keewahdin Road, Fort Gratiot, Michigan 48059. If you would like to set a specific time to register with the Clerk or Deputy Clerk, please call (810) 385-4489. You may, but are not required to, complete and print the form prior to coming to the office, found here: Michigan Voter Registration Form. If registering 0-14 days prior to an election, voters must register in-person at the Clerk’s office and must provide proof of residency. Click here for a list of acceptable documents.

ONLINE. To register online, you must have a current Michigan Driver’s License or Personal Identification Card and qualify to vote in the state of Michigan: Register Online.

BY MAIL. If your current address is within Fort Gratiot, return your form to the Clerk’s office at the Fort Gratiot Municipal Office, 3720 Keewahdin Road, Fort Gratiot, Michigan 48059. Click on this link to obtain a form: Michigan Voter Registration Form.

OTHER AGENCIES. There are local agencies that may also provide voter registration services to their clients, including the Council on Aging, Department of Human Services, Department of Community Health and Military Recruitment Centers.

CHANGE YOUR ADDRESS. If you have moved, you can your change your driver’s license, personal ID and voting address by visiting the Secretary of State’s website at: www.michigan.gov/vote.

ABSENTEE VOTING

Absentee voter (AV) ballots are available for all elections, providing voters with an alternate method for casting a ballot when they are unable to attend the polls, or if they prefer to vote at home and return the ballot to the Clerk’s office.

ABSENTEE BALLOT REQUEST. If you would like to request an absentee ballot for a single election, please complete the Absent Voter Ballot Application and return to the Clerk’s office, or apply online here: Online Absentee Ballot Request

A voter must submit an absentee ballot application before an absentee ballot can be sent. Voters can request an absentee ballot up to 75 days before an election by submitting a completed absentee ballot application to their local clerk. Absentee ballots are available and distributed beginning 40 days before the election.

Michigan voters can decide to be placed on a permanent absentee ballot list. Their local clerk will then mail them an absentee ballot.

For information on military and overseas absentee voting, visit the military and overseas voting section.

PERMANENT ABSENTEE BALLOT LIST. If you prefer to vote absentee and receive your ballot in the mail, consider signing up to be on the permanent list. Placement on this list means that you will automatically receive your ballot in the mail approximately 40 days prior to all scheduled local, state, and federal elections to the address our office has on file. A signed request is required if you would like to be placed on this list. If interested, please complete the form and check the box in section 2 under Other Elections: Absent Voter Ballot Application

RETURNING BALLOTS. Ballots must be received in the Fort Gratiot Clerk’s office no later than 8:00 PM on election day to be counted, though we encourage voters to return ballots as soon as possible. Remember to sign the envelope provided or the ballot cannot be counted. Someone in your immediate family or living in your household can help you deliver this application. If that’s not possible, you can ask any Michigan registered voter to deliver it for you. The person helping you must sign “Certificate of Authorized Registered Elector Returning Absent Voter Ballot Application” on the envelope. Voters may return their voted ballots by mail (state-funded return postage is included,) in-person or by using our secure ballot drop box, located in front of the FGMC.

TRACK YOUR ABSENTEE BALLOT. Click this link to view the status of your application and/or ballot: Track Your Absentee Ballot

EMERGENCY BALLOTS. If an emergency, such as a sudden illness or family death prevents you from reaching the polls on election day, you may request an emergency absent voter ballot. Requests must be submitted after the deadline for regular absent voter ballots has passed, but before 4:00 p.m. on election day. The emergency must have occurred at a time which made it impossible for you to apply for a regular absent voter ballot. Please contact the Clerk’s office for more information about emergency absent voter ballots.

EARLY IN-PERSON VOTING

Both early in-person voting and absentee voting allow voters to cast a ballot prior to Election Day. However, there are key differences between the two methods of voting.

- Early voting allows voters to cast a ballot similar to how they would do so at a polling place on Election Day. Voters are issued a ballot and can personally insert it into the tabulator at their early voting site.

- Absentee voting allows voters to request a ballot by mail or in person at their local clerk’s office. Voters can complete their absentee ballot at home or at their local clerk’s office and submit it in an envelope by mail, in person, or by drop box. After an absentee ballot is received by the local clerk, the voter’s absentee ballot is processed and tabulated by their local clerk.

Absentee voters also have more flexibility to “spoil” their ballot, or change their vote, after it has been submitted.

VOTER ASSISTANCE EQUIPMENT

WORK AS AN ELECTION DAY INSPECTOR!

The Fort Gratiot Clerk’s Office is looking for people to work the polls on Election Day. By serving as an Election Inspector, also referred to as a poll worker, residents can serve their community, see their neighbors, be engaged in the democratic process and earn extra income at the same time!

Each county, city, and township in Michigan hires and pays election inspectors for the early voting period and on Election Day. Election inspectors are hired, paid, and trained local government workers who assist with running local elections in compliance with Michigan Election Law.

Inspectors will be stationed at one of the 4 precincts throughout Fort Gratiot and will be responsible for opening the precinct on Election Day, ensuring voters are registered and are voting in the proper precinct, assigning ballots and closing the polls. Election Inspectors are paid for working on Election Day and also receive additional payment for attending mandatory training prior to Election Day. Election Inspectors must be a qualified and registered elector of the State of Michigan.

Interested in becoming an Election Inspector? Contact the Clerk’s office today! Election Inspector Application

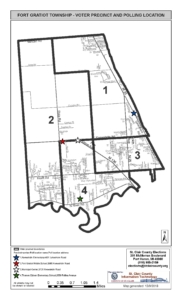

VOTING PRECINCTS

A few changes and consolidations were made in 2020, including the closure of Precinct 5, the Pointe Community Center. To verify your current registration info, you may contact the Clerk’s office or check online, here: Voter Registration Lookup

Precinct 1: Keewahdin Elementary, 4801 Lakeshore Road

All voters living on the north side of Brace Road between Parker Road and State Road, all EVEN addresses between 3728-3998 Brace Road, vote in Precinct 1, at Keewahdin Elementary School.

All voters living on the East Side of State Road from between Brace Road and Metcalf Road, all EVEN addresses between 5514-5802 State Road, will vote in Precinct 1, at Keewahdin Elementary School.

Precinct 2: Fort Gratiot Middle School, 3985 Keewahdin Road

Precinct 3: Fort Gratiot Municipal Center, 3720 Keewahdin Road

Precinct 4: Thomas Edison Elementary, 3559 Pollina Avenue

Former Precinct 5, the Pointe Community Center, was consolidated with Precinct 1, and votes at Keewahdin Elementary. Follow this link for the full 2020 Precinct Changes and March 2020 Election Information

INFORMATION FOR CANDIDATES RUNNING FOR TOWNSHIP OFFICE

Candidates wishing to be on the ballot for public offices in Fort Gratiot must file original documents no later than 4:00 p.m. on the 15th Tuesday before the August election. For this term, the deadline for the August 6, 2024 Primary Election is 4:oo p.m. on April 23, 2024. The complete packet of forms is available in the Clerk’s Office.

Candidates for the following positions file receive forms and file with the Fort Gratiot Clerk’s Office:

- Fort Gratiot Supervisor

- Fort Gratiot Clerk

- Fort Gratiot Treasurer

- Fort Gratiot Trustee (four positions)

- Fort Gratiot Park Commissioner (five positions)

Every candidate must submit the following forms, which are available by contacting Clerk Robert Buechler at (810) 385-4489 x 1104 or [email protected]. Because incomplete or incorrect forms cannot be accepted late, candidates are strongly encouraged to submit the packet prior to the deadline so that any necessary corrections can be made to ensure the candidate is included on the ballot.

- Affidavit of Identity

- Nominating Petitions with sufficient signatures, or, in lieu of petitions, a $100 non-refundable filing fee, made payable to Fort Gratiot Township.

- Statement of Organization(If you plan on expending or receiving over $1,000 you must also file required campaign finance reports.)

FIRE DEPARTMENT

Emergency: 911

Office: (810) 385-5666

Fax: (810) 385-7813

Email: [email protected]

Burning permits are required for all burning and can be obtained on an annual (January-December) basis free of charge at the fire department. Please call for more information.

The burning of leaves and building materials is prohibited.

Current Applicable Fire Code, adopted in Ordinance 206, effective July 12, 2011

Sec. 14-31. Adoption of International Fire Code.

(a) A certain document, a copy of which is on file in the office of the fire department, being marked and designated as the International Fire Code, as published by the International Code Council, is hereby adopted by reference as the fire code of the township, regulating and governing the safeguarding of life and property from fire and explosion hazards arising from the storage, handling and use of hazardous substances, materials and devices, and from conditions hazardous to life or property in the occupancy of buildings and premises as provided in this section; providing for the issuance of permits and collection of fees; and each and all of the regulations, provisions, penalties, conditions and terms of such fire code on file in the office of the township are hereby referred to, adopted and made a part hereof, as if fully set out in this section, with the additions, insertions, deletions and changes, if any, prescribed in this section. Chapter 14, Fire Prevention and Protection, Section 14-32 of the Code of Ordinances, Charter Township of Fort Gratiot, Michigan, is hereby deleted in its entirety.

ORDINANCES AND REGULATIONS

Maps

Street Map

Thoroughfare Plan Map 2008-2030

General Regulations

Blight

Weeds & Noxious Weeds (tall grass) Ordinance

Operation of Off Road Vehicles on County Roads

Recreational Vehicle Regulations

Stables, Kennels and Farm Animals

Building and Development Regulations

C-2 General Business District Regulations

Temporary Outdoor Sales Ordinance

Fort Gratiot Master Plan 2020-2025

Click here to be redirected to the Code of Ordinances at www.municode.com The online codes are updated through Ordinance 186. The links above will take you to an updated section.

ZONING BOARD OF APPEALS

ATTENTION INTERESTED FORT GRATIOT RESIDENTS

THE ZONING BOARD OF APPEALS IS SEEKING TWO ALTERNATE MEMBERS FOR A THREE (3) YEAR TERM

The Fort Gratiot Charter Township Zoning Board of Appeals meets on the third Tuesday of each month, as needed, beginning at 7:00 PM, in the Gardendale Meeting Room at the Fort Gratiot Municipal Center (FGMC,) 3720 Keewahdin Road, Fort Gratiot, Michigan 48059.

The ZBA hears requests for dimensional variances, appeals of the zoning code, and requests for interpretation of the zoning code. Training opportunities are available, and members are compensated $100 per attended meeting.

Interested parties may submit a letter of interest to the Board of Trustees, in person or by mail to the FGMC or email at [email protected]. Appointments will be made at a meeting of the Board of Trustees, held on the first and third Wednesday of each month.

If you have an questions, please contact the Office of Community Development at (810) 385-4489 x1113 or [email protected].

Posted 02/19/2025

***

The ZBA meets on the third Tuesday of each month in the Fort Gratiot Municipal Center Gardendale Meeting Room, beginning at 7 PM. If no requests are received for the ZBA to take action, the meeting may be cancelled.

3720 Keewahdin Road

Fort Gratiot, Michigan 48059

Office: (810) 385-4489 x1113

Facsimile: (810) 385-9010

Email: [email protected]

The links below, courtesy Michigan State University Extension (2023,) are informational flyers designed to help any member of the public, a neighborhood association, or citizen group better understand the process and participate at Zoning Board of Appeals and Planning Commission public hearings.

Citizen Participation Guide for ZBA Appeals and Variances – Zoning Board of Appeals

Citizen Participation Guide for Zoning Amendments – Planning Commission

Citizen Participation Guide for Special Land Use Requests – Planning Commission

SUPERVISOR’S OFFICE

Rob Montgomery

Supervisor

Email: [email protected]

Mailing Address: 3720 Keewahdin Road, Fort Gratiot, MI 48059

Phone: (810) 385-4489 x1100

Website: www.fortgratiot.us

Official Fort Gratiot Facebook: www.facebook.com/fgtwp

Core Competencies: The Building Blocks of Township Government

To ensure that all township officials have the opportunity to learn what they need to know to carry out their statutory duties as well as understand effective township management practices, the Michigan Townships Association has identified “core competencies.” Essentially, they are the “nuts and bolts” that each of the four elected offices at the township level should know and/or be skilled in to successfully perform their duties.

The list should not be construed as all-inclusive; rather they should be considered an overview of the knowledge and skill sets that an individual should possess. Note that each checklist is dynamic in the sense that it will change over time, adapting to legislation, legal issues, and other factors that impact township government and the responsibilities of the elected official.

The core competencies address two goals: (1) to create a more-informed, better-educated cadre of township officials who are more confident and competent in carrying out their roles and responsibilities as leaders in their communities; and (2) to generate greater effectiveness on the part of local government. Below are the core competencies for the Supervisor. Please visit the Clerk, Treasurer, and Board of Trustees pages to see the core competencies for those positions.

Township Government Operations

~Demonstrates knowledge about township (general law or charter) government responsibilities, functions and powers

~Identifies the major functions of each branch of government—local, state and federal—along with their relationship to one another

-Understands the statutory duties and responsibilities of the office of township supervisor

~Aware of the roles and responsibilities of other elected and appointed offices in the township

~Demonstrates knowledge of the various committees, boards and commissions serving the township, including their roles and responsibilities

~Understands how township policies and procedures are set

~Demonstrates knowledge of how ordinances are lawfully adopted and legally enforced

Interpersonal Skills

~Communicates effectively

~Listens attentively

~Works effectively with individuals, departments, and committees to achieve desired outcomes

~Possesses knowledge of what constitutes ethical behavior

~Manages adversity and hostility effectively

Leadership Abilities

~Possesses vision, especially relative to the township’s needs or potential

~Leads effective board meetings and is knowledgeable about parliamentary procedure

~Possesses effective policy-making skills and decision-making skills

~Utilizes consensus-building techniques

~Possesses persuasive/influential abilities

~Motivates others to achieve desired outcomes

~Utilizes public relations skills to position the township positively

Management Skills

~Makes decisions consistent with desired outcomes

~Utilizes strategic planning to attain objectives

~Develops and oversees the budget

~Understands purchasing policies and the bid process

~Possesses knowledge of personnel administration

~Understands the collective bargaining process, including legal framework (only applicable to some townships)

~Negotiates issues and contracts effectively

Township Issues

~Possesses knowledge about current issues affecting townships

~Aware of legal matters that could impact the township

~Understands the elements of risk management

~Aware of financial matters affecting the township, including revenue sources

~Possesses knowledge about land use

~Understands the planning and zoning process

~Possesses knowledge of township services and their policy implications

CLERK’S OFFICE

Robert D. Buechler

Clerk

Email: [email protected]

(810) 385-4489, ext. 1104

Office of the Clerk

Vicki Ostrander – Deputy Clerk

Email: [email protected]

Phone: (810) 385-4489 x1103

Nancy Decoursey – Accountant

Email: [email protected]

Phone: (810) 385-4489 x1102

Election Dates and Voting Precinct Map: Voting Precincts 2012

Core Competencies: The Building Blocks of Township Government

To ensure that all township officials have the opportunity to learn what they need to know to carry out their statutory duties as well as understand effective township management practices, the Michigan Townships Association has identified “core competencies.” Essentially, they are the “nuts and bolts” that each of the four elected offices at the township level should know and/or be skilled in to successfully perform their duties.

The list should not be construed as all-inclusive; rather they should be considered an overview of the knowledge and skill sets that an individual should possess. Note that each checklist is dynamic in the sense that it will change over time, adapting to legislation, legal issues, and other factors that impact township government and the responsibilities of the elected official.

The core competencies address two goals: (1) to create a more-informed, better-educated cadre of township officials who are more confident and competent in carrying out their roles and responsibilities as leaders in their communities; and (2) to generate greater effectiveness on the part of local government. Below are the core competencies for the Clerk. Please visit the Supervisor, Treasurer, and Board of Trustees pages to see the core competencies for those positions.

Township Government Operations

~Demonstrates knowledge about township (general law or charter) government responsibilities, functions and powers

~Identifies the major functions of each branch of government—local, state and federal—along with their relationship to one another

~Understands the statutory duties and responsibilities of the office of township clerk

~Aware of the roles and responsibilities of other elected and appointed offices in the township

~Demonstrates knowledge of the various committees, boards and commissions serving the township, including their roles and responsibilities

~Understands how township policies and procedures are set

~Demonstrates knowledge of how ordinances are lawfully adopted and legally enforced

Interpersonal Skills

~Communicates effectively

~Listens attentively

~Works effectively with individuals, departments and committees to achieve desired outcomes

~Possesses knowledge of what constitutes ethical behavior

~Manages adversity and hostility effectively

~Delegates tasks appropriately

Leadership Abilities

~Possesses vision, especially relative to the township’s needs or potential

~Understands how to conduct effective board meetings and is knowledgeable about parliamentary procedure

~Possesses effective policy-making skills and decision-making skills

~Utilizes consensus-building techniques

~Possesses persuasive/influential abilities

~Motivates others to achieve desired outcomes

~Utilizes public relations skills to position the township positively

Administrative Skills

~Possesses knowledge of the communication/noticing needs of the township and devises strategies to assemble and disseminate information to relevant audiences

~Understands the township budget and the clerk’s role in monitoring budget

~Aware of purchasing policies and the bid process

~Demonstrates knowledge of uniform chart of accounts and township accounting practices

~Possesses understanding of personnel administration and human resources matters

~Has ability to transcribe minutes of the proceedings of each township board meeting in an accurate and proper manner

~Understands maintenance of township records, books and papers in accordance with record retention and disposal guidelines

~Possesses knowledge of elections and clerk’s role in overseeing the elections process

Township Issues

~Possesses knowledge about current issues affecting townships

~Aware of legal matters that could impact the township

~Understands the elements of risk management

~Aware of financial matters affecting the township, including revenue sources

~Possesses knowledge about land use

~Understands the planning and zoning process

~Possesses knowledge of township services and their policy implications

TREASURER’S OFFICE

Calls for tax amounts, special assessments and water & sewer account questions may be directed to the treasurers office at (810) 385-4489 x1118

George F. Wells

Treasurer

Email: [email protected]

Phone: (810) 385-4489, ext. 1114

Under MCL 211.44(2), on the last day of February each year, the Treasurer’s Office will be open between 9:00 a.m. and 5:00 p.m. If the last day of February falls on a weekend, extended office hours will then be held the following Monday. This statute also provides the Treasurer’s Office remain open for one day from 9:00 a.m. until 5:00 p.m. sometime between December 25th and January 1st. Generally, the Treasurer’s Office extends office hours this day on the last business day the Township is open during the chosen week.

Township Funds:

The Treasurer’s Office is responsible for the collection of Taxes, Water Bills, Permit Fees, and any other fees or payments owed. The Treasurer’s Office is also responsible for depositing, investing, and transferring funds to cover payments, as well as balancing bank statements. The Treasurer also assists in generating yearly budgets, and twice a month provides a complete financial report on all Township funds to the Board of Trustees.

Payment Options:

Payments may be made in person, by mail, or by being placed in the after-hours drop box by check or cash. Credit card payments can be made in person or online, but cannot be accepted over the phone. All payments placed in the drop box on the due date are considered on time. Payments sent via mail are considered on time if postmarked on or before the due date. To pay online, follow the links below. For the utility bill, select the “Search by Address” option, leave the street name blank and enter your street number in both “Street Number” boxes and click “Search.” This will bring up all Fort Gratiot properties with that street number. Select yours and follow the prompts. For tax bills, you can use any of the search options available on the screen. There are several screens to verify your information before you are charged, including the screen showing the credit card fee. For all credit card transactions the fee is 3% of the transaction, with a minimum fee of $2.00. The fees go directly to the credit card company. You will receive a confirmation email from [email protected] with a confirmation number and the transaction details. Click here to pay your utility bill online. Click here to pay your tax bill online.

or by phone: 833-819-5112 fees do apply

Automatic (ACH) Withdrawal payments are also offered. These payments will automatically be deducted from your checking/savings account on the due date each billing period. To enroll, please complete the forms below and submit to the Treasurer’s office. Please note that the auto payments continue until written notice of cancellation is received.

Designated Agent Forms:

If an individual other than the homeowner, such as a mortgage company, is responsible for paying taxes, a Designated Agent form must be filled out and kept on file with the Treasurer’s Office, as required by MCL 211.44(9)(a) passed in April, 1999.

Deferment of July Property Taxes:

If certain criteria are met, July tax on principal residences may be deferred until February 14th without penalty, under MCL 211.51. Applications for this deferment must be filed with the Township Treasurer’s Office no later than September 15th. Gross household income must be under $35,000, and applicants must be at least 62 years of age, an eligible serviceperson or veteran, or disabled as set forth in the law.

July Property Tax Bills:

July tax bills are mailed July 1st, and are due by September 14th at 5pm without penalty. Partial payments are accepted on all taxes. A 2% penalty is added to any unpaid balance on September 15th, with another 1% being added the first of each month thereafter, until the books are closed on March 1st. The July tax bill consists of Port Huron Area School District, St. Clair County RESA (formerly ISD), State Educational Tax, and St. Clair County Operating Tax. The Treasurer’s Office then distributes the taxes collected to the School District, RESA, State and County.

December Property Tax Bills:

December tax bills are mailed December 1st, and are due by February 14th at 5pm without penalty. Effective February 15th, a 3% penalty is assessed on any unpaid balance. February 28th is the last day to pay Summer or Winter taxes. The December bill includes taxes for the Blue Water Area Transportation Commission; County Operations; including the St. Clair County Drug Task Force, St. Clair County Senior Citizens, County Parks, County Library, and Community College; as well as Fort Gratiot Township Operations; including Township Fire, Police, and Special Assessments. As with the July tax bills, the Treasurer’s Office distributes the collected funds to all individual entities.

Garage Sale Permits:

Under Township Ordinance #89, each household is allowed 3 garage sales in any 12 month period. Each sale can span 4 consecutive days. Garage Sale permit fees are $2.00, and all permits must be displayed for the duration of the sale.

2017 PROPERTY TAX PREPAYMENT INFORMATION

Taxes cannot be prepaid for 2018 in Michigan because the 2018 taxes have not been assessed yet.

In areas of Michigan and in other states where municipalities are accepting prepayment, the IRS has not confirmed that it will accept the prepayment.

The IRS has received a number of questions from the tax community concerning the deductibility of prepaid real property taxes. In general, whether a taxpayer is allowed a deduction for the prepayment of state or local real property taxes in 2017 depends on whether the taxpayer makes the payment in 2017 and the real property taxes are assessed prior to 2018.

A prepayment of anticipated real property taxes that have not been assessed prior to 2018 are not deductible in 2017. State or local law determines whether and when a property tax is assessed, which is generally when the taxpayer becomes liable for the property tax imposed.

The General Property Tax Act in Michigan (MCL 211.1-211.157) does not allow for local governments to accept prepayment of taxes. We can only do that which we are permitted to do by state law. Such provision simply does not exist.

At present there is no property tax levied for 2018. That will not occur until the assessors make their assessments, send out assessment notices in February 2018, allow for property owners to protest their assessments at the Board of Review in March 2018, allow for the county equalization department to complete their process in April 2018, and allow for the various taxing jurisdictions to levy their millage in conjunction with the adoption of their budgets which in some cases takes place in May and early June 2018. Therefore, the property tax does not become a tax owing until July 1, 2018.

Therefore, since there exists no property tax yet for 2018, the taxpayer does not have a tax that can be itemized on their 2017 federal income tax form.

Core Competencies: The Building Blocks of Township Government

To ensure that all township officials have the opportunity to learn what they need to know to carry out their statutory duties as well as understand effective township management practices, the Michigan Townships Association has identified “core competencies.” Essentially, they are the “nuts and bolts” that each of the four elected offices at the township level should know and/or be skilled in to successfully perform their duties.

The list should not be construed as all-inclusive; rather they should be considered an overview of the knowledge and skill sets that an individual should possess. Note that each checklist is dynamic in the sense that it will change over time, adapting to legislation, legal issues, and other factors that impact township government and the responsibilities of the elected official.

The core competencies address two goals: (1) to create a more-informed, better-educated cadre of township officials who are more confident and competent in carrying out their roles and responsibilities as leaders in their communities; and (2) to generate greater effectiveness on the part of local government. Below are the core competencies for the Treasurer. Please visit the Supervisor, Clerk, and Board of Trustees pages to see the core competencies for those positions.

Township Government Operations

~Demonstrates knowledge about township (general law or charter) government responsibilities, functions and powers

~Identifies the major functions of each branch of government—local, state and federal—along with their relationship to one another

~Understands the statutory duties and responsibilities of the office of township treasurer

~Aware of the roles and responsibilities of other elected and appointed offices in the township

~Demonstrates knowledge of the various committees, boards and commissions serving the township, including their roles and responsibilities

~Understands how township policies and procedures are set

~Demonstrates knowledge of how ordinances are lawfully adopted and legally enforced

Interpersonal Skills

~Communicates effectively

~Listens attentively

~Works effectively with individuals, departments, and committees to achieve desired outcomes

~Establishes appropriate contacts with banks, mortgage companies, insurance and investment firms

~Possesses knowledge of what constitutes ethical behavior

~Manages adversity and hostility effectively

~Delegates tasks appropriately

Leadership Abilities

~Possesses vision, especially relative to the township’s needs or potential

~Understands how to conduct effective board meetings and is knowledgeable about parliamentary procedure

~Possesses effective policy-making skills and decision-making skills

~Utilizes consensus-building techniques

~Possesses persuasive/influential abilities

~Motivates others to achieve desired outcomes

~Utilizes public relations skills to position the township positively

Administrative Skills

~Demonstrates knowledge of uniform chart of accounts, generally accepted accounting practices and proper internal controls

~Implements sound cash management procedures and proper handling of funds, including knowledge of investment instruments and legal limitations on investments

~Understands elements of investment risks

~Aware of what constitutes lawful township expenditures

~Has ability to generate required financial reports and statements, which are accurate and timely

~Understands the audit process

~Possesses knowledge of the township budget and can project reasonable cash flows on an annual basis

~Understands purchasing policies and the bid process

~Demonstrates knowledge of general property tax administration process, including collection and distribution of tax revenues

~Understands procedures for collecting personal property taxes

Township Issues

~Possesses knowledge about current issues affecting townships

~Aware of legal matters that could impact the township

~Understands the elements of risk management

~Aware of financial matters affecting the township, including revenue sources

~Possesses knowledge about land use

~Understands the planning and zoning process

~Possesses knowledge of township services and their policy implications

BOARD OF TRUSTEES

The Fort Gratiot Charter Township Board is made up of the Supervisor, Clerk, Treasurer and four Trustees. These are all elected positions with four year terms; the election cycle being the same as the office of the United States President. Click here to review the Michigan Township Association Core Competency Handbook for Elected Officials

The members are as follows, until November 2028:

Supervisor, Robert Montgomery, elected 2024 ([email protected])

Clerk, Robert Buechler, elected 2024 ([email protected])

Treasurer, George Wells, elected 2024 ([email protected])

Trustee Scott Bradley, elected 2024 ([email protected])

Trustee Linda Bruckner, elected 2024 ([email protected])

Trustee Robert C. Crawford, elected 2024 ([email protected])

Trustee Adam James Armbruster, elected 2024 ([email protected])

Core Competencies: The Building Blocks of Township Government

To ensure that all township officials have the opportunity to learn what they need to know to carry out their statutory duties as well as understand effective township management practices, the Michigan Townships Association has identified “core competencies.” Essentially, they are the “nuts and bolts” that each of the four elected offices at the township level should know and/or be skilled in to successfully perform their duties.

The lists should not be construed as all-inclusive; rather they should be considered an overview of the knowledge and skill sets that an individual should possess. Note that each checklist is dynamic in the sense that it will change over time, adapting to legislation, legal issues, and other factors that impact township government and the responsibilities of the elected official.

The core competencies address two goals: (1) to create a more-informed, better-educated cadre of township officials who are more confident and competent in carrying out their roles and responsibilities as leaders in their communities; and (2) to generate greater effectiveness on the part of local government. Below are the core competencies for a Trustee. Please visit the Supervisor, Clerk and Treasurer pages to see the core competencies for those positions.

Township Government Operations

~Demonstrates knowledge about township (general law or charter) government responsibilities,

functions and powers

~Identifies the major functions of each branch of government—local, state and federal—along with

their relationship to one another

~Understands the duties and responsibilities of the office of township trustee

~Aware of the roles and responsibilities of other elected and appointed offices in the township

~Demonstrates knowledge of the various committees, boards and commissions serving the township,

including their roles and responsibilities

~Understands how township policies and procedures are set

~Demonstrates knowledge of how ordinances are lawfully adopted and legally enforced

Interpersonal Skills

~Communicates effectively

~Listens attentively

~Works effectively with individuals, departments and committees to achieve desired outcomes

~Possesses knowledge of what constitutes ethical behavior

~Demonstrates behavior that results in public trust

~Manages adversity and hostility effectively

Leadership Abilities

~Possesses vision, especially relative to the township’s needs or potential

~Understands how to be an active participant in board meetings and is knowledgeable about

parliamentary procedure

~Possesses effective policy-making skills and decision-making skills

~Utilizes consensus-building techniques

~Possesses persuasive/influential abilities

~Motivates others to achieve desired outcomes

~Utilizes public relations skills to position the township positively

Policymaking Skills

~Understands how to objectively monitor administrative actions for compliance with existing

policy and law, and to ensure that policies and practices serve the public well

~Knows how to critically examine proposals to evaluate how the proposed policies and practices

could affect the township

~Creates effective systems for establishing rapport with constituents, ensuring that voters’

needs are brought to the attention of the township board

~Understands how to constructively participate in, or lead, committees, including setting

objectives and goals, conducting productive meetings, and providing accurate reports

~Utilizes effective research techniques to become more knowledgeable about matters that come

before the township board and/or committees

~Understands the budget process, financial statements and how to use fiduciary responsibilities

to manage the township’s affairs in the best interests of the public

~Understands purchasing policies and the bid process

~Possesses knowledge of contracts, including intergovernmental agreements

Township Issues

~Possesses knowledge about current issues affecting townships

~Aware of legal matters that could impact the township

~Understands the elements of risk management

~Aware of financial matters affecting the township, including revenue sources

~Possesses knowledge about land use

~Understands the planning and zoning process

~Possesses knowledge of township services and their policy implications

MUNICIPAL CENTER 2014

MUNICIPAL OFFICE AND FIRE STATION CONSTRUCTION PROJECT

BID SPREADSHEET: Click Here for Received Bids 03-18-2014

Bidders were required to submit a percentage of local participation and submit the actual list of local companies by 2:00 PM on Wednesday, March 19. Only four submitted a percentage; one submitted a list of names, but addresses to verify location; one submitted a list of names and addresses but not a percentage; and the remaining two submitted no local participation plan at all. The Board of Trustees and CHMP will work with the bidders to gather more information regarding local participation and to begin value engineering on certain aspects of the project. A decision on how to proceed will be made within sixty (60) days.

The bids were publicly opened and read aloud at 2:00 PM today at the Township Hall. The list of contractors who submitted a bid are below.

BERNCO, INC., 20816 11 Mile Rd., Ste. 202; St. Clair Shores, MI 48081

BODDY CONSTRUCTION, 3741 Dove Rd., Port Huron, MI 48060

BROWN BUILDERS, 6836 Wiltsie Rd., Lexington, MI 48450

DEGENHARDT & SONS, 2610 Binbrooke Drive, Troy, MI 48084

E & L CONSTRUCTION GROUP, INC., P.O. Box 418, Flint, MI 48501

MICCO CONSTRUCTION, 715 Auburn Ave., Pontiac, MI 48342

MJC CONSTRUCTION MANAGEMENT, 46600 Romeo Plank Rd., Ste. 5, Macomb, MI 48044

SG CONSTRUCTION SERVICES, LLC., 3407 Torrey Rd., Flint, MI 48507

O’BRIEN CONSTRUCTION COMPANY, 966 Livernois, Troy, MI 48083 – WITHDREW 03/18/2014

A.W.ELLIS CONSTRUCTION, INC., 221 Runnels St., Port Huron, MI 48060-WITHDREW 03/03/2014

FOR IMMEDIATE RELEASE MARCH 7, 2014:

THE BID DUE DATE HAS BEEN EXTENDED. Bids will be received by Fort Gratiot Charter Township located at 3720 Keewahdin Road, Fort Gratiot, Michigan 48059 until 2:00 PM, Tuesday, March 18, 2014.

The last day for questions is Tuesday, March 11, 2014, 5:00 PM. All inquiries should be directed to the office of the Architect:

Attention: Gregory N. Mason, A.I.A.

Email: [email protected]

Phone (810) 695-5910; Fax (810) 695-0680.

CHMP, INC.

5198 Territorial Road

Grand Blanc, Michigan 48439

BIDS ARE DUE AT 2:00 PM, Tuesday, March 18, 2014

• Sealed bids are due at 3720 Keewahdin Road, Fort Gratiot, Michigan 48059 by 2:00 PM, 03/18/2014.

• The bidder must be present at the bid opening.

• All bids will be publicly unsealed and read aloud.

• After all bids have been read, the bidders will be excused.

• Bids will be awarded within 60 days.

BID DOCUMENTS:

The files below can be downloaded. However, if you choose to download the files you must either email us your information so that we may send to you any addenda that are issued, or you are solely responsible to check this page for updates. All addenda will be posted here. A disc can also be purchased at the Township Hall, Monday-Friday, 8AM – 4:30 PM.

FOR BID PURPOSES- FGMC Construction Drawings 02-18-2014

FOR BID PURPOSES – FGMC Specifications 02-18-2014

ADDENDA:

02/27/2014 – Addendum One Drawings 2-27-14 and Addendum One Write-up 2-27-14

03/07/2014 – Addendum Two Drawings 3-7-14 and Addendum Two Write-up 3-7-14

CLICK HERE FOR A LIST OF SUBCONTRACTORS PRESENT 02-27-2014

Project Engineer: Eric Ostling, Huron Consultants (810) 966-0680 Huron Consultants website

Project Architect: Greg Mason, CHMP, Inc. (810) 695-5910 CHMP, Inc. website

General Contractor: Sorenson Gross Construction Services, 3407 Torrey Road, Flint, Michigan 48507

Phone: 810-767-4821 ~ Fax: 810-238-6222 ~ E-mail: [email protected]

Click Here to View the Floor Plan – NOT FOR BID PURPOSES

Click Here to View the Building Elevations – NOT FOR BID PURPOSES

Click Here to View the Site Plan – NOT FOR BID PURPOSES

Click Here to View the Existing and Proposed Structures on the Site

What’s Happened So Far…

04/02/2014 – The Fort Gratiot Board of Trustees unanimously accepted the low bid from Sorenson Gross Construction Services.

02/27/2014 – A meeting was held at the Fort Gratiot Township Hall; mandatory for all pre-qualified general contractors and optional for subcontractors. Following the presentation was a “meet and greet” for subcontractors and general contractors, the architect and engineers.

02/18/2014 – Bid documents were made available in a digital format only, and can be purchased at the Township Hall, 3720 Keewahdin Road, Fort Gratiot, Michigan, 48059 and on this page, above. A $10 nonrefundable fee is required to purchase the disc. The files will be in an Adobe Reader (.pdf) format. At the time of purchase, we will need the company name, a contact name, mailing address, telephone, fax and email address. This information will be used if any addenda to the bid documents are issued. If you have downloaded the documents from the website, please email [email protected] to be added to a list to have any potential addenda emailed. Any addenda will also be posted to the website.

01/14/2014 – Site Plan Approval granted by the Fort Gratiot Planning Commission

12/17/2013 – Side Yard Setback Variance granted by the Fort Gratiot Zoning Board of Appeals

12/10/2013 – Special Land Use Approval granted by the Fort Gratiot Planning Commission

Project: Fort Gratiot Township Municipal Center

Legal Descriptions: The parcels will be combined when the building currently housing SB Heating on Parcel B is demolished. Parcel A: 74-20-768-0055-000, 3720 Keewahdin Road (Existing Hall/Fire Department) – Lot 31 Except East 8’, Lots 29 & 30, West 8’ of Lot 32 Lying North of Lot 31 & That Part of Lot 28 Lying East of the Warner Drain. Supervisor’s Teeple Pine Grove Avenue Plat.

Parcel B: 74-20-768-0056-000, 3700 & 3704 Keewahdin Road (Former Stoutenberg homestead and currently SB Heating) – East 8′ of Lot 31 & Lot 32 Except West 8′ Lying North of Lot 31. Supervisor’s Teeple Pine Grove Avenue Plat.

Background: The buildings on Parcel B date back to the 1940’s; an auto repair business in the block building on the southwest corner that is currently home to SB Heating, a small house behind the business which was demolished in 2013, and a 2-story single family residence on the southeast. The 2-story home was built by the Stoutenberg family in 1947 and was moved onto 4331 Carrigan Road in Fort Gratiot in 2013. The Stoutenberg’s were all very active with Fort Gratiot Township. Harold was the Fort Gratiot Fire Chief from 1952 – 1975. Jean Stoutenberg, who resided in the home until her death in 2008, was the recording secretary for the Fort Gratiot Planning Commission and Zoning Board of Appeals, and was the head of the women’s auxiliary for the fire department. Throughout the years Jean worked in various departments within the Township, helping out wherever she could. Their sons, Dick, Bob & Jerry also served on the Fort Gratiot Fire Department for many years.